FiDA Partnership is publishing a mini series on various insights derived from an analysis of the third edition of the Evidence Gap Map (EGM). This is the third blog.

- Blog 1: Inching closer to understanding the digital finance impact question

- Blog 2: Digital savings—The evolving story of how and when digital savings products work

Last year we summarized the digital credit impact insights garnered by the EGM 2.0. Now in its third edition, the EGM has five additional digital credit studies in its evidence base. By compounding existing evidence and/or presenting new insights on the impact (or lack thereof) of different design and delivery mechanisms—these studies are valuable additions to the evolving impact story.

What are the insights so far?

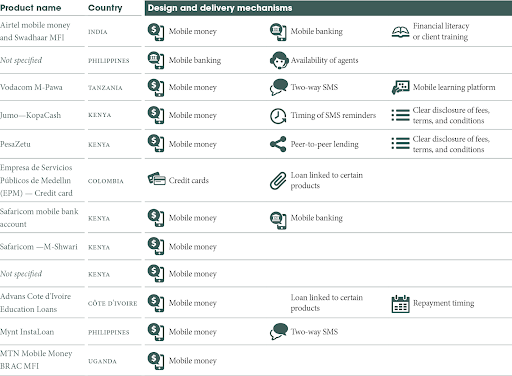

The EGM now includes 12 studies evaluating the effect of digitally enabled credit products (in seven countries). These studies involved different markets, client segments, and design and delivery mechanisms, accordingly, we should be cautious about drawing any overarching conclusions. The table below illustrates the diversity of the digital credit products that were tested.

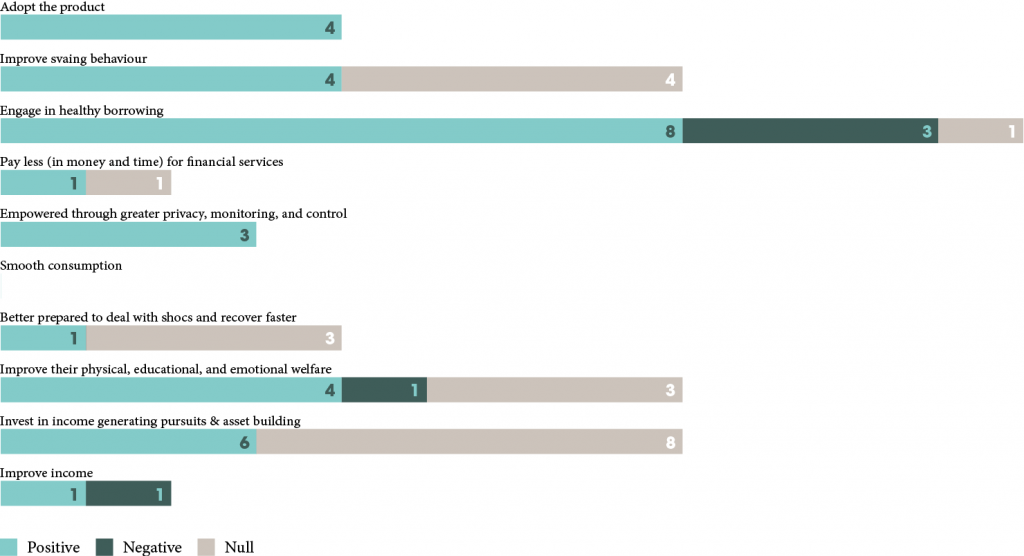

These studies include 51 tested outcomes, with “healthy borrowing” being the primary outcome focus. The diagram below shows the outcomes tested and the number of studies that had a positive, negative, or null effect; 75 percent of the credit products tested showed only positive results and 25 percent showed mixed results. It is still early days; clearer patterns may emerge as more products are tested and we continue to synthesize the evidence.

Our previous credit impact insights

In our previous review of digital credit we found the following overarching insights:

- The framing and timing of SMS reminders can improve repayment rates and protect borrowers. But differential effects were observed between men and women.

- Making T&Cs more salient and accessible can lead to better borrowing behavior and repayments.

- Using interactive content on financial literacy showed promising results for repayment behavior.

- An existing financial ecosystem may improve the use of individual financial services, such as using savings to access loans.

- Beyond borrowing behavior insights were limited.

The new credit studies contribute to the previous insights relating to the use of SMS for improved borrowing behavior and add new insights on longer-term outcomes where very few previously existed.

Spotlight on new digital credit studies

All credit products are not equal: Emerging insights on the income and welfare effects

- Formerly, there were very limited insights into welfare or income outcomes related to digital credit. Now, three new studies have joined the evidence-based conversation on the income and welfare effects of digital credit.

- A CGAP-supported study collaborated with Advans Cote d’Ivoire to provide cocoa farmers with loans for their children’s educations. Pre-approved farmers were able to request loans through the Advans USSD menu and receive quick confirmation. Borrowers received their loans in time to cover school expenses and repaid them in installments as they sold their cocoa. This flexible, tailored loan resulted in the number of children who started school on time increasing from 49 percent to 73 percent.

- In an RCT with BRAC Uganda, researchers tested the disbursement of MFI loans via a mobile money channel for female business owners. This relatively straightforward digitization of the disbursement channel generated numerous positive effects for female business owners:

- Business assets/inventory: An 11 percent (about $35) increase in the value of business assets/inventory was observed in the mobile disbursement group.

- Business sales: 15 percent higher for the mobile disbursement group, both weekly and monthly.

- Business profits: Eight months post loan, researchers found a 15 percent increase in business profits; a 10 percent greater increase in profits than the control group. In fact, despite the loans, profits actually declined by 6 percent between baseline and endline in the control group.

- Increases in consumption: Significant increases in overall consumption for the mobile disbursement treatment group were observed. This increase in consumption corresponds roughly to the observed increase in business profits.

- Impact mechanisms: Women who experienced the most pressure at baseline to share money with family experienced the largest treatment impacts. This group saw a 25 percent increase in business profits and a 17 percent increase in business capital compared to the control. Furthermore, they found that women who received the mobile disbursement treatment gave significantly less money to their spouses ( nearly 50% less), whereas the control group actually increased the amount they gave to their spouses after receiving their business loan. These findings—echoed in numerous other studies—suggest that the privacy that mobile channels affords women is a key driver for the impact observed.

- Nearly seven years after its launch, the first experimental study of M-shwari was published. The study compared new M-Shwari account holders who had barely qualified for loans to individuals who had barely missed qualifying for loans. Testing a wide range of outcomes, they found that households with individuals above the M-Shwari cutoff were 6.3 percentage points less likely to report foregone expenses in the event of a shock and 5.8 percentage points more likely to report positive expenditure on education compared to households below the cutoff. No impact was observed on other outcomes such as value of assets, savings, income, employment, and consumption. This suggests that M-Shwari has primarily helped households manage liquidity and bridge cash shortfalls rather than invest in and build assets that may lead to improvements in incomes and wealth.

These new studies contribute new insights to our previously limited understanding of the impact of digital credit. How a product is designed and delivered matters tremendously. For instance, a loan that is tailored to income cycles and has a designated function (i.e.,education) leads to more children in school. Similarly, by addressing the visibility of business loans, women did decidedly better. With M-Shwari, people are free to spend as they wish, but, given the relatively low value and short-term nature of these loans, it is perhaps not surprising that the study finds no impacts on other measures of welfare.

Two way SMS: Increasing confidence in the channel but still in the dark on the content

- In last year’s update we noted a study that highlighted how two-way SMS on financial literacy improved clients’ repayment behavior in Tanzania. A new addition provides more evidence on two-way SMS.

- In a CGAP-supported study, Mynt partnered with Juntos to improve adoption and repayments of their Instaloan product in the Philippines. A comparison of the percentage of customers who missed at least one weekly payment in the first five weeks of their loan cycle shows that 9 percent fewer of the Juntos-treated customers missed a payment compared to the control group.

This study adds to the concept of using two-way SMS to improve repayment behavior. However, neither study highlights what the content was and thus learning is limited. As previously shown in studies on digital savings—The wrong message is worse than no message at all—and thus, although the channel has been shown to work, the important part, effective content, remains less clear.

Credit and savings: Do they work together?

- In last year’s update we outlined one study that tested the effect of credit (in the form of a credit card) on savings (specifically, access to savings accounts) and found no effect.

- Two additional studies have now tested the effect of digital credit on savings outcomes. The M-Shwari study found that access to M-Shwari had no effect on various savings outcomes. And the mobile disbursed business loan study found that female business owners were significantly more likely to save on mobile devices and had higher balances, but the values were of limited economic significance and may reflect a reallocation of savings between devices rather than an increase in total savings.

There is, so far, very little evidence (or theory) that access to credit boosts savings.

Bringing insights together

None of the new studies have challenged the previously noted insights, but they have provided further support or added new insights. From the additional studies we found:

- Complementary insights on using SMS and behavioral science to improve repayment behavior—though learning is constrained by a lack of understanding around effective content.

- Multiple insights on the impacts of digital credit on longer-term outcomes which highlight that the design and delivery of digital credit products varies the impact observed:

- Low-value, short-term loans improve household liquidity and response to shocks but were not found to affect wealth, consumption, or labor outcomes.

- Women benefited from the reduced visibility of digitized loans, which reduced pressure to share and thus significantly improved their business and household outcomes.

- Service- or product-linked loans that are adapted to a client segment’s income cycles produced the desired effect; that is, they increased children’s access to education.

The insights gathered thus far are encouraging and, as a community, we should continue to look for opportunities to gather evidence on the effects of digital credit products. Filling in the remaining gap in our knowledge—particularly around variations in product design and delivery, markets, and client segments— will benefit the digital credit community’s ability to design appropriate and high impact products.

The studies in the EGM represent our best knowledge of digital finance impact insights. New studies are continuously emerging and thus the EGM will continue to evolve. If you have questions on the EGM, are interested in discussing research priorities, or know of relevant digital finance impact studies that meet the inclusion criteria, please contact ideas@financedigitalafrica.org.