GSMA’s COVID-19 Response Tracker that monitors mobile money-specific regulatory policy, government, and provider interventions globally, is now public.

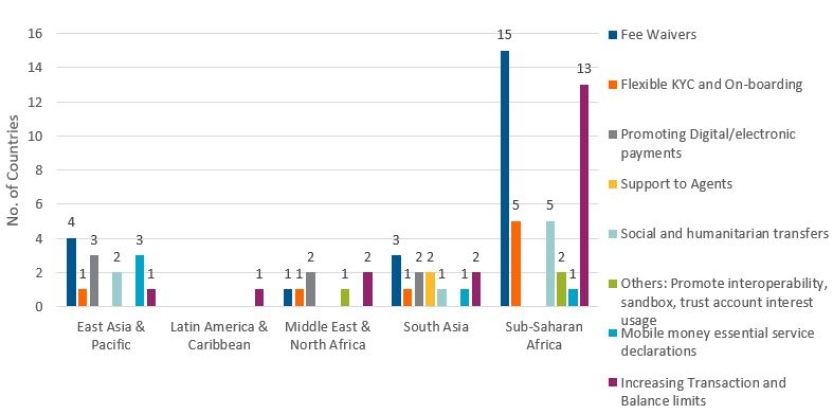

The tracker which is updated weekly collates data from 32 countries, spread across Sub-Saharan Africa (17), East Asia & Pacific (7), South Asia (4), Middle East & North Africa (3), and Latin America & Caribbean (1).

Key insights

- Fee waivers, increasing transaction and balance limits, flexible KYC and on-boarding and social and humanitarian transfers are the most commonly used regulatory measures to fight the immediate impact of COVID-19.

- In terms of the popularity of policy responses by region, 15 out of 17 countries in SSA and seven out of 11 countries in APAC leveraged fee waiver as a preferred instrument to effectively respond to COVID-19.

- A majority of the regulators have specified validity periods of COVID-19 specific fee waivers with some extending until year-end 2020 while some are limited to only 30 days

- The best practice response goes to the National Bank of Rwanda (BNR) that announced the reinstatement of mobile money transaction charges following three months of zero-rated transfers. The decision was made to ensure the financial sustainability of digital payment services.