The Mastercard Foundation Partnership for Finance in a Digital Africa is pleased to share the final report from its first exploration of “DFS Use by Digital Kenyans”.

The report is based on a representative sample of 1,000 Kenyans with data-enabled mobile phones—“Digital Kenyans”—gathered between September and November 2017 by Caribou Data.

Caribou Data transparently recruits and compensates individuals for participating in its panels, using cutting-edge techniques such as differential privacy and on-device anonymization to ensure that participants are effectively anonymous and cannot be re-identified. As a result, Caribou Data can offer data and insights previously unavailable to most of the DFS community.

The research includes insights on DFS use in the context of other phone-based activities, explores DFS use by activity, and offers an illustrative segmentation focused on the distinctions between “basic” and advanced DFS use.

-

DFS use among digital KenyansRead now

Our findings suggest that DFS use is common but not without challenges. Most of the smartphones in our sample are older/outdated, underpowered, or nearly full—all factors detrimental to the user experience. Urban users take advantage of 3G and Wi-Fi coverage, while rural users spend the majority of their time under slower 2G signals. A “metered mindset” alongside uncertain income streams lead many users to top up data in small amounts. And yet, people still spend more time in DFS sessions than WhatsApp or SMS, perhaps because SIM menus remain the most popular interface for payments.

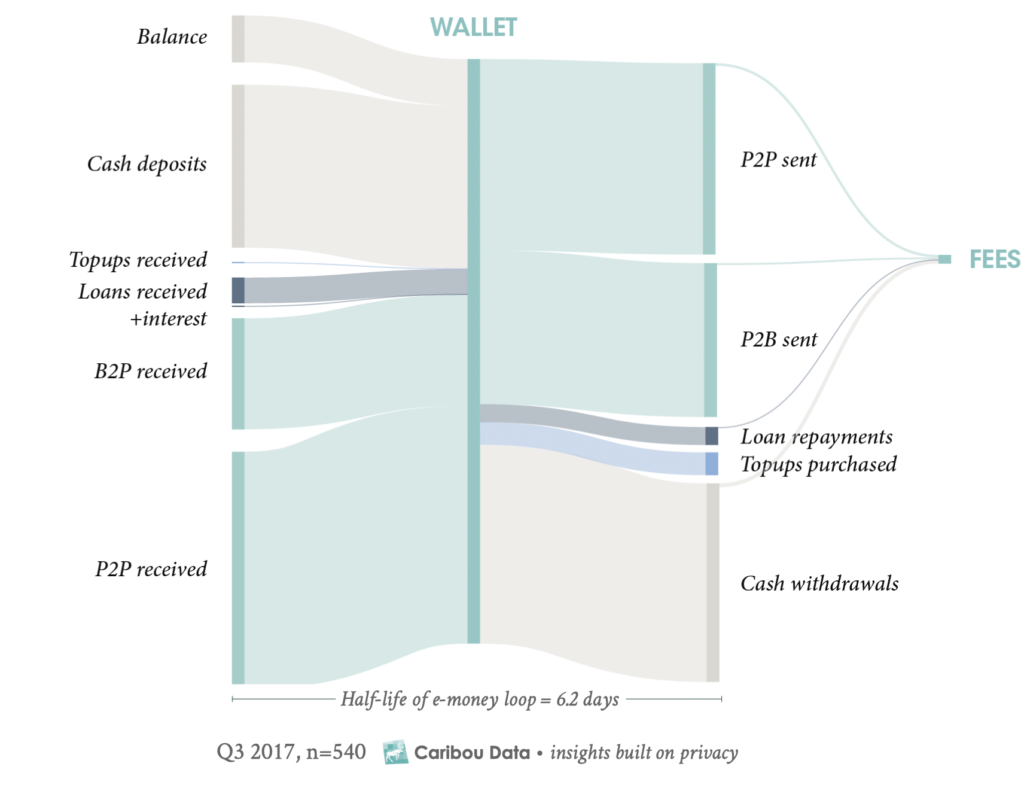

Our data reaffirms and reflects existing observations: not everyone in Kenya is an active DFS user, and not everyone uses DFS in the same way. Indeed, only 13% of 90-day active users in our panel used DFS frequently enough to be considered effectively “daily” users . Our “cash flow dashboard” illustrates how some users keep cash digital, while others may be quicker churners. And, even though we have found that top-ups, P2P, and cash-in/out are common among active users, savings and loans are much rarer.

To illustrate some of these differences in DFS use, we created a behavioral segmentation of our 90-day active user base, contrasting infrequent vs. frequent users, and “savers” vs. “borrowers”.

Considerable differences emerge between these segments, including demographic (borrowers trend male; savers, female) and the degree to which users keep cash digital (infrequent users keep funds digital longer than daily users). Even among “advanced” users in the saving and borrowing segments, there are indications of challenges to effective use, notably evidence of overpaying for unused data, and gambling.

Products need to be designed for simplicity and resource-constraint. Short codes still outpace in-app behaviors. Feature phones are common, and many smartphones are underpowered, old, and “full”.

Nevertheless this analysis underscores that there there is plenty of room (and need) for digital Kenyans to move into more advanced and regular DFS use. Only about half of our sample were active DFS users, and of that, the majority only infrequent users of “basic”.

We offer this for product managers, fintech entrepreneurs, policymakers, and DFS practitioners alike. Please download and share, and let us know your thoughts.