Introduction

Worldwide, 2 billion people lack access to formal financial services. The financial inclusion agenda is committed to including this population within the formal financial system. In an ideal world, the digital finance community could design and deploy products, services, programs, and policies specifically designed to appeal to the excluded — to connect the unconnected, bank the unbanked, empower the unempowered, etc. In practice, however, the digital finance community seldom achieves such narrow tailoring. Instead, systems are understood, adopted, and used across broad populations, usually with differing degrees of success. Several factors, such as age, literacy, gender, geography, and language — often in “intersectional” combinations — shape the nature of the adoption, use, and impact of digital finance.

In this Snapshot, we make salient some of the persistent issues surrounding exclusion, as well as how we measure exclusion, in digital finance research. We present these insights to sensitize researchers and practitioners to the complexities and significance of these dynamics, inviting them to explore how the diverse variables of exclusion ultimately affect how marginalized groups experience outcomes.

Current insights

Early adopters are not the excluded

Designing digital finance products and services for marginalized, excluded groups is challenging. Considering the numerous barriers to accessing and using digital finance, designing for the inverse of excluded groups — banked, educated, tech-savvy, usually male individuals with higher social statuses — is much easier. Consequently, these included segments of society have tended to be the first to adopt and use digital finance in the majority of less developed markets.1 For example, a 2012 survey of Ugandan households found that mobile technologies and mobile money services were predominantly used by males with a secondary education or higher who were of prime working age.2 More recently, a 2017 survey on Kenyan digital borrowers highlighted that digital credit appeals to younger customers who tend to be male, urban, and relatively highly educated.3 Although (as discussed in Snapshot 2) there has been trickle down in uptake over time, this profile of early adopters is common, especially in the nascent stages of market development.4

These adoption trends can be explained by Everett M. Rogers’ 1964 “Diffusion of Innovation” theory in which he explains how ideas and technology spread from “early adopters” to later adopters and finally “laggards” — the last group to adopt an innovation.5 Rogers describes laggards as traditionalists who tend to be of low social status and low financial liquidity and are among the as oldest portion of adopters.6 His portrayal of late adopters shares many of the characteristics of excluded populations in low-income and less developed markets. Based on this understanding of adoption, the challenge is that financial inclusion will not come from the first 20% of a population who adopt and use these services; full financial inclusion will have been achieved only when the last 20% get on-board.

Unpacking the dynamics of exclusion

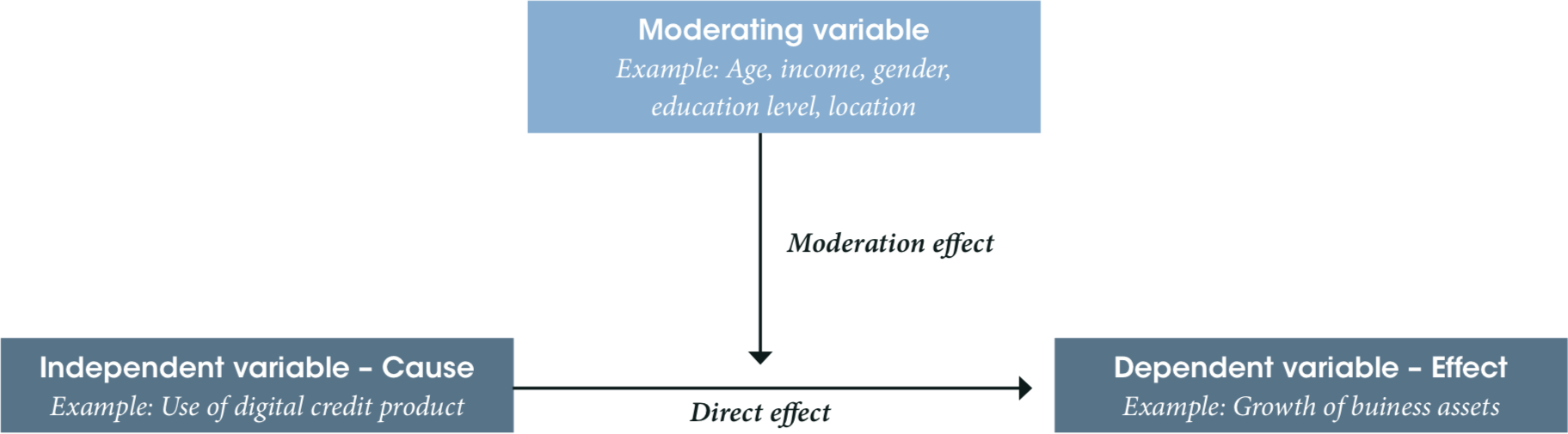

One approach to thinking about inclusion and exclusion, and targeting impacts within marginalized populations, is to think about the differential impacts of uptake and use of digital financial services. Looking at the differential impacts of digital financial services moves beyond a presumption of linear, universal impact of a technology to look at the ways in which various factors — such as age, literacy, gender, geography, and language — might influence the extent to which a given technology has an “impact” on the user. Interaction occurs when the effect of an independent variable on a dependent variable differs across different levels of a moderating variable (Figure 1), that is, when use of a digital credit product’s effect on an outcome like “growth of business assets” is heightened or reduced depending on the age, education level, etc. of the client.

Figure 1: Moderation effects

Adapted from Anderson et al. 2014

A robust community of researchers is working with these concepts, and some readers might want to refer to texts on the ideas of interaction effects, moderating variables, or non-linear impacts.7 Even without these advanced texts or specialized terms, however, we can explore the differential impacts of our theories of change, or narratives around how the technologies we build, impact the populations we wish to work with. As this field of inquiry matures and we learn more about the problems we wish to solve, researchers and developers must identify and define the relevant and meaningful interaction effects of relationships between independent and dependent variables in order to make further progress.8

Be wary of any presumption of universal impact

The easiest, and perhaps most pervasive, narrative around the impact of technologies on a given population is a variant on the notion that a rising tide lifts all boats. In digital financial services, this generalized understanding assumes that the people adopting technology late in the game will respond to it in the same way and garner the same impacts as those who adopted a technology earlier. That is, digital finance providers too often assume there is little difference between being the first micro-enterprise on the block to use mobile payments and being the last.

Conversely, research that has explored the effect of a given digital financial service on a particular demographic group such as women, rural populations, or older populations illustrates how such services do or do not impact the traditionally excluded. However, in order to identify and understand the impact of digital finance on an excluded group, such research must be read in the context of similar studies on a more included segment, that is, by comparing female to male or rural to urban. For example, imagine that an impact study has found that the use of a digital credit product improved the financial health of the population studied. Digital finance practitioners need to ask who was included in the research population? Were they young, old, male, female, middle or lower income, from a rural or urban area? Were there any differences in the effects experienced by certain demographics?

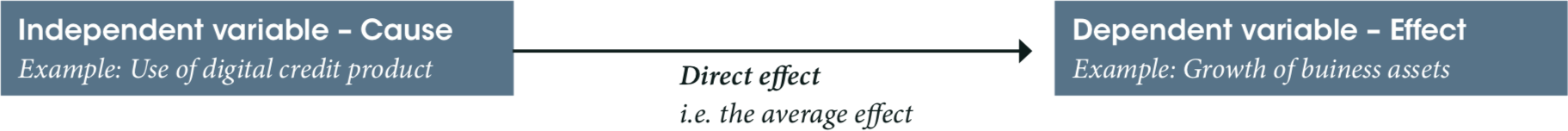

Yet, research rarely presents dis-aggregated insights. Instead studies report the “average treatment effect” which suggests that every individual included in the study experienced the reported effects equally.

Figure 1: Average effects

Adapted from Anderson et al. 2014

A review of digital finance impact studies from FiDA’s Evidence Gap Map found that 78% of studies did not include the most basic variable: gender disaggregated data. Only 8% provided a gender lens on a single outcome and 5% segmented results by both women and men. For other distinctions — like age, education, and income — we know even less.

While some studies demonstrate the impact of digital finance on one group, many have failed to correlate these insights with less excluded segments such as by comparing the impact of digital finance on men vs. women or on farmers vs. non-farmers. For example, Wyche’s research highlighted that mobile phones, and the services that come with them, are intensifying rather than breaking down existing inequalities among rural women in Kenya.9 Basing her work on the “amplification theory,” which proposes that technology magnifies institutional forces and existing inequalities, Wyche concludes that mobile services benefit network providers while disadvantaging rural female phone owners.10

While the observations are insightful, only women were studied.The lack of comparison between two distinct groups, in this case women and men, reduces the utility of impact studies in terms of understanding whether the effects are experienced more or less by different population segments. When technologies such as digital financial services are designed for broad populations, it is easy but unwise to presume that these technologies will be used in the same way by — and have the same impacts on — different demographics within a given population.

Celebrate cases where the marginalized benefit more from a technology

It’s not easy, but occasionally a digital financial service or other technology will be designed so carefully and be so in tune with the needs of an excluded group, that the benefits of using the technology do indeed accrue disproportionately to the target users. When this happens, technologies can close gaps in productivity, income, efficacy, or other variables of concern to the development community.

In a study of M-Pesa in Kenya, evidence emerged that M-Pesa users did not resort to reducing consumption, as a coping mechanism when they faced a negative economic shock, for example, after a poor harvest or when a family member has fallen ill. Further, the effects were shown to be more evident for the bottom three quintiles of income distribution than for the top.11 Another impact study, in Burkina Faso, highlighted that while the use of mobile money did not make any difference in the savings behavior of relatively advantaged groups (urban, male, and highly educated), it did increase the probability of saving for health emergencies for disadvantaged groups (rural, female, and less educated). More precisely, the study found that individuals living in a rural area were three times more likely to save with mobile money than those in urban areas. Women were six times more likely to save with mobile money than men and less educated individuals were four times more likely than higher educated individuals to save using mobile money.12 Additionally, a Kenyan panel study on mobile money reported that mobile money access reduced both extreme and general poverty and that the effects were more pronounced in women — women being affected more than twice as much as the average.13

These studies have introduced instances where being female, less educated, lower income, or from rural areas is associated with a greater accrual of effects from digital finance programs.

Identify cases where the marginalized may benefit less from a technology

Unfortunately, there are many cases in which the benefits of a technology accrue predominantly to high status, high skill individuals, rather than to the marginalized population for whom we often wish to design. There are hints of this dynamic as far back as the “Diffusion of Innovation” paradigm we mentioned earlier as well as in the “knowledge gap” hypothesis14 and in Toyama’s “amplification” arguments.15

Digital finance studies that have examined impact on more excluded groups have shown that the assumption that impact is homogenous does not hold water.

- Schaner’s study on the effects of ATM cards on bank account use found that while ATM cards increased account use among male-owned and joint accounts, a negative impact was found on female-owned accounts. The hypothesis was that intra-household pressures to share savings drove women to stop using their accounts when an ATM card reduced the transaction costs of accessing their money.16

- Examining mobile money use and household food security in Uganda, Murendo, and Wollni found that mobile money adoption was associated with improved household food security. However, there were significant differences with respect to education levels and landholdings. Better educated mobile money users and those with larger landholdings were more likely to have higher agricultural productivity and to be food secure than those with less education and smaller landholdings.17

- Testing the effects of of a roving Point of Service (PoS) on savings account use, Romero and Nagarajan observed differential levels of impacts based on wealth levels. For households at the top of the wealth distribution, an increase in savings services was associated with less reliance on distressed asset depletion to cope with economic shocks. The effect was the opposite for those at the bottom of the wealth distribution.18

These interaction observations provide the digital finance community with a refined understanding of impact by determining the conditions under which impact applies, or is stronger or weaker. They also underscore the need to examine how a digital finance product may interact with and affect various excluded groups.

Accept that since there are many factors at play, all of these different dynamics maybe present

We rarely get to make causal statements like A causes X for everybody and in the same way. It’s more often the case that A may cause X, Y, or Z, in different amounts and at different rates depending on factors F, G, H, and I.

Some of these multifactorial, contingent impacts can be illustrated using the language of intersectionality which seeks to explain how interlocking structures of privilege impact those that are most marginalized.19 Consider the experience of an illiterate, elderly woman seeking to use a digital finance product. Each of these potentially marginalizing factors — literacy, age, and gender — should not be viewed as separate factors. Instead, researchers should consider the interactions between all of these exclusionary factors. Specifically, researchers should take into account how these factors might reinforce and compound each other. To highlight the complexity of exclusion in digital finance, we have foregrounded a selection of factors that can influence how an excluded group interacts with a digital finance product and how this might contribute to variations in the impact of said products or services on their lives.

- Gender: By the end of 2015, 46% of the African population had subscribed to a mobile service.20 While impressive, this subscription is unbalanced. Most notable is the gender gap in mobile ownership — in Africa 27 million fewer women than men own a phone.21

- Geography: Challenges persist in increasing mobile adoption in remote areas constrained by additional factors ranging from low income and purchasing power to social and political instability.22 Dynamics of inclusion may be further complicated by the shift towards the delivery of services through smartphones and mobile broadband because only 16% of the African population has access to 4G and only 50% has access to 3G.23

- Smartphones: While digital literacy challenges across feature phones are important to note, introducing smartphones brings a new level of technical exclusion. Research from the Mozilla Foundation found that inexperience “disrupts confidence in smartphone use and causes confusion about digital identity.”24 The study identified 53 digital skills required to leverage smartphones and use digital products with “confidence, agency and competence.”

- Analog literacy and numeracy: Access to a mobile phone is one thing, the capability to use it is another. Even for those with access to a feature phone, poor literacy and numeracy reduce the likelihood of using a mobile money service.25 The Helix Institute found that illiteracy impeded customers’ ability to conduct person to person (P2P) transactions.26 And research conducted by CGAP found literacy and numeracy issues to be a huge barrier to digital finance adoption among women in Pakistan.27

- Financial literacy: As mentioned in Snapshot 1 —What financial needs can be (and should be) addressed by DFS? — the recent proliferation of Kenyans blacklisted by the credit bureau due to outstanding loans is evidence of low financial literacy among certain clients.28 The Digital Credit Observatory has highlighted consumer protection issues brought on by increased access to digital credit.29 These range from over-borrowing to privacy issues in the use of data for credit scoring.30

- Digital skills: Digital illiteracy represents a further barrier to financial inclusion. CGAPs Smallholder Diaries research found that 68% of Tanzanian farmers, 25% of Mozambican farmers, and 24% of Pakistani farmers had the ability to send and receive an SMS.31 For most rural users, a basic feature phone will be their first digital device. For them “using a mobile phone is like learning a new language.”32

- Social and cultural norms: Beyond primary and secondary digital divides, social and cultural norms also affect the uptake and use of digital finance and further contribute to dynamics of exclusion. Barriers to women adopting mobile money, often influenced by social and cultural norms, include lack of access to a mobile phone33 or formal identification34 and having limited agency outside the home35 and amplified price sensitivity.36 As a result, the gender gap looms large in digital financial services.37

Many of these barriers are fundamentals that must be addressed to oil the wheels of digital financial inclusion. They include both primary access divides and secondary skill-based challenges.38 The dynamics of exclusion make it hard to design and implement inclusive digital finance products and services but not impossible.

What to do

Build theories of change that include moderating and mediating variables

It all comes back to having strong theories of change that allow for impacts to accrue differently to different user groups. A theory of change describes how, and under what conditions, an program or product is expected to contribute to change. One attribute of a strong theory of change is that it encompasses a deep awareness of the operational context and thus of users. Such an awareness is fundamental to understanding the potential impact heterogeneity and, ergo, designing impact research.

However, the sheer quantity of potential moderating variables in digital finance can be daunting. From the few digital finance studies that have examined interaction effects, we see evidence of gender, income, education, assets, and geography interacting with the outcome of interest. However, as noted above, age, literacy, numeracy, digital skills, and infrastructure may also affect the level and direction of impact, but have not yet been evaluated. The choice of moderating variables should be based on a clear theory regarding why, or under what conditions, a given relationship is influenced by age, gender, income, education, etc. To do this we need to upgrade our theories to account for potential interaction effects.

Support and evaluate these theories of change with research that detects differential effects

Interaction effects may provide the digital finance community with valuable insights on the conditions under which impact is either enhanced or weakened. But simply exposing an interaction effect between independent and moderating variables on an outcome is insufficient.39 Interaction effects need to be explained in order to advance theory and, ultimately, produce digital finance products that can reach and positively impact the excluded. Using previous theories and insights from the data, claims such as “The effect of X on Y is enhanced/weakened when Z is present because Z alters the mechanism in this way” become possible.

As we discussed in Snapshot 15, “How do we assess the heterogeneous impacts of digital finance intervention,” there are many ways to account for differential effects, even without full-blown randomized control trials. Regardless of the methods chosen, it’s important to include evaluation frames that compare the impacts of the use of a given technology on target communities with those outside the target community. Case studies with farmers are useful, but without looking at the way technology is used by non-farmers, it is impossible to argue that a technology has been more or less helpful to those farmers than it would have been to other segments of the population. Without those comparative levels and without conceptual theories about how technology use interacts with exclusion and inclusion, researchers can’t make good claims about the most effective means of closing the gap.

Conclusion

Digital finance practitioners and researchers are bound by time, budget, and incentives. The call to action is not for everyone to research, design products for, and conduct impact evaluations on every factor of exclusion in every context. No one can do it all which is why synthesis documents are valuable. However, every insight into designing for and testing the impact of digital finance products for excluded groups advances the digital finance community. Excluded groups are a large untapped market. Not only should their financial needs be addressed from a philanthropic viewpoint, but increased use of digital finance is also a commercial opportunity. There are tremendous gains from unraveling the interaction effects of exclusion variables. A heightened awareness of these challenges will help practitioners plan appropriate digital finance services that their underserved clients will want to use, and be capable of using, regularly. Moreover, without an enhanced understanding of these dynamics, these divides will only compound exclusion.

10 Must Reads in this space

- Andersson, Ulf, Alvaro Cuervo-Cazurra, and Bo Bernhard Nielsen. 2014. From the Editors: Explaining Interaction Effects within and across Levels of Analysis. Journal of International Business Studies 45.9 (20149): 1063–71

- Gammage, Sarah, Aslihan Kes A., Liliane Winograd L., Naziha Sultana N, Sara Hiller S, and Shelby Bourgault S. 2017. Gender and digital financial inclusion: What do we know and what do we need to know?. ICRW, 2017.

- Anderson, Jamie, and Wajiha Ahmed. 2016. Smallholder Diaries: Building the Evidence Base with Farming Families in Mozambique, Tanzania, and Pakistan. CGAP, 2016.

- Reynal, Laura de, and Bobby Richter. 2016. Stepping into Digital Life. Mozilla Foundation, 2016.

- McCaffrey, Mike, and Doreen Ahimbisibwe. 2015. Digital Finance and Illiteracy: Four Critical Risks. December 2015.

- Hargittai, Eszter. 2002. Second-Level Digital Divide: Differences in People’s Online Skills,. 2002. First Monday, April.

- Wyche, Susan, Nightingale Simiyu, and Martha E. Othieno. 2016. Mobile Phones as Amplifiers of Social Inequality among Rural Kenyan Women. ACM Transactions on Computer-Human Interaction: A Publication of the Association for Computing Machinery 23. (3 (2016)): 1–19.

- Schaner, Simone. 2016. The Cost of Convenience? Transaction Costs, Bargaining Power, and Savings Account Use in Kenya,. 2016.

- Murendo Conrad, and Meike Wollni. 2016. Mobile Money and Household Food Security in Uganda. Department of Agricultural Economics and Rural Development, Georg-August-University of Goettingen, 37073 Goettingen, Germany, 2016.

- Romero, Jose, and Geetha Nagarajan. 2011. Impact of Micro-Savings on Shock Coping Strategies in Rural Malawi. IRIS Centre,. 2011.

Bibliography

- Anderson, Jamie, and Wajiha Ahmed. “Smallholder Diaries: Building the Evidence Base with Farming Families in Mozambique, Tanzania, and Pakistan.” CGAP, 2016. http://www.cgap.org/sites/default/files/CGAP_Persp2_Apr2016-R.pdf.

- Andersson, Ulf, Alvaro Cuervo-Cazurra, and Bo Bernhard Nielsen. “From the Editors: Explaining Interaction Effects within and across Levels of Analysis.” Journal of International Business Studies 45, no. 9 (December 1, 2014): 1063–71.

- Arnold, Julia. “Women Mobile Phones and Savings – Grameen Foundation Case Study.” Grameen Foundation, October 2012. http://www.grameenfoundation.org/resource/women-mobile-phones-and-savings-case-study.

- Barrie, Georgia, Jamal Khadar, and Stephanie Gaydon. “Women and Mobile Money: Insights from Kenya.” GSMA, 11/2015. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/02/Connected-Women-Women-and-Mobile-Money-Insights-from-Kenya-Nov15.pdf.

- Bin-Humam, Yasmin, and Caroline Ayes. “How Social Norms Affect Women’s Financial Inclusion.” CGAP, August 3, 2017. http://www.cgap.org/blog/how-social-norms-affect-women%E2%80%99s-financial-inclusion.

- Cooper, Brittney. “Intersectionality.” In The Oxford Handbook of Feminist Theory, edited by Lisa Disch And. Oxford University Press, 2016.

- Francis, Eilin, J. Blumenstock, and Jonathan Robinson. “Digital Credit in Emerging Markets: A Snapshot of the Current Landscape and Open Research Questions.” The Digital Credit Observatory, June 2017. http://www.digitalcreditobservatory.org/uploads/8/2/2/7/82274768/dco_landscape_analysis.pdf.

- Gsma. “State of the Industry 2015: Mobile Financial Services for the Unbanked.” GSMA, November 2016. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/11/SOTIR_2015.pdf.

- ———. “State of the Industry Report on Mobile Money: Decade Edition: 2006-2016,” February 2017. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/02/GSMA_State-of-the-Industry-Report-on-Mobile-Money_Final-27-Feb.pdf.

- ———. “The Mobile Economy: Africa 2016.” GSMA, 2016. https://www.gsmaintelligence.com/research/?file=3bc21ea879a5b217b64d62fa24c55bdf&download.

- GSMA. “The Mobile Economy Sub-Saharan Africa 2017.” London, 2017. https://www.gsma.com/mobileeconomy/sub-saharan-africa-2017/.

- ———. “Unlocking the Potential: Women and Mobile Financial Services in Emerging Markets,” 02/2013. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2013/02/GSMA-mWomen-Visa_Unlocking-the-Potential_Feb-2013.pdf.

- Hargittai, Eszter. “Second-Level Digital Divide: Differences in People’s Online Skills.” First Monday, April 2002. http://firstmonday.org/article/view/942/864.

- Jack, William, and Tavneet Suri. “Risk Sharing and Transactions Costs: Evidence from Kenya’s Mobile Money Revolution.” The American Economic Review 104, no. 1 (January 1, 2014): 183–223.

- Johnson, Susan, Graham K. Brown, and Cyril Fouillet. “The Search for Inclusion in Kenya’s Financial Landscape: The Rift Revealed.” FSD Kenya, March 2012. http://fsdkenya.org/publication/the-search-for-inclusion-in-kenyas-financial-landscape-the-rift-revealed-summary-report/.

- Ky Serge, and Clovis Rugemintwari. “Does the Adoption of Mobile Money Affect Savings? Evidence from Burkina Faso.” Université de Limoges, LAPE, 5 rue Félix Eboué, 87031 Limoges Cedex, France., 2015. https://afse2015.sciencesconf.org/61843/document.

- Lonie, Susan, Martinez Meritxell, Christopher Tullis, and Rita Oulai. “The Mobile Banking Customer That Isn’t: Drivers of Digital Financial Services Inactivity in Côte d’Ivoire.” The MasterCard Foundation, IFC, 2015. http://www.ifc.org/wps/wcm/connect/fe1c69804aa2b52e9f60df9c54e94b00/Final+CDI+Inactivity+Report+ENGLISH.pdf?MOD=AJPERES.

- McCaffrey, Mike, and Doreen Ahimbisibwe. “Digital Finance and Illiteracy: Four Critical Risks,” December 2015. http://www.cgap.org/blog/digital-finance-and-illiteracy-four-critical-risks.

- Mirzoyants, Anastasia. “Mobile Money in Uganda The Financial Inclusion Tracker Surveys Project – Use, Barriers and Opportunities.” InterMedia, October 2012. https://www.microfinancegateway.org/sites/default/files/mfg-en-paper-mobile-money-in-uganda-use-barriers-and-opportunities-oct-2012.pdf.

- Morawczynski, Olga, and Mark Pickens. “Poor People Using Mobile Financial Services : Observations on Customer Usage and Impact from M-PESA.” The World Bank, August 1, 2009. http://documents.worldbank.org/curated/en/943831468149671681/Poor-people-using-mobile-financial-services-observations-on-customer-usage-and-impact-from-M-PESA.

- Murendo Conrad, and Meike Wollni. “Mobile Money and Household Food Security in Uganda.” Department of Agricultural Economics and Rural Development, Georg-August-University of Goettingen, 37073 Goettingen, Germany, 2016. http://ageconsearch.tind.io/record/229805/files/GlobalFood_DP76.pdf.

- Reynal, Laura de, and Bobby Richter. “Stepping into Digital Life.” Mozilla Foundation, December 2016. https://d20x8vt12bnfa2.cloudfront.net/reports/Stepping+Into+Digital+Life+-+Digital+Skills+Observatory+Research+Report.pdf.

- Rogers, Everett M. Diffusion of Innovations. Thirds. Macmillan, 1962,1971,1983.

- Romero, Jose, and Geetha Nagarajan. “Impact of Micro-Savings on Shock Coping Strategies in Rural Malawi.” IRIS Centre, 2011. http://www.fsassessment.umd.edu/publications/pdfs/iris-shocks-bill-melinda-gates-foundation.pdf.

- Schaner, Simone. “The Cost of Convenience? Transaction Costs, Bargaining Power, and Savings Account Use in Kenya,” 2016. http://www.poverty-action.org/sites/default/files/publications/The-Cost-of-Convenience-April-2016.pdf.

- Shrader, Leesa. “Digital Finance in Bangladesh: Where Are All the Women?” CGAP, May 2, 2015. http://www.cgap.org/blog/digital-finance-bangladesh-where-are-all-women.

- Simanowitz, Anton, Shweta Banerjee, and Antonique Koning. “Customer Views on Customer Empowerment.” CGAP, December 2014. http://www.cgap.org/sites/default/files/india_summary_report.pdf.

- Suri, T., and W. Jack. “The Long-Run Poverty and Gender Impacts of Mobile Money.” Science 354, no. 6317 (December 9, 2016): 1288–92.

- Tichenor, P. J., G. A. Donohue, and C. N. Olien. “Mass Media Flow and Differential Growth in Knowledge.” Public Opinion Quarterly 34, no. 2 (January 1, 1970): 159–70.

- Totolo, Edoardo. “Kenya’s Digital Credit Revolution Five Years On.” CGAP, March 15, 2018. http://www.cgap.org/blog/kenya%E2%80%99s-digital-credit-revolution-five-years.

- Toyama, Kentaro. “Technology As Amplifier in International Development.” In Proceedings of the 2011 iConference, 75–82. iConference ’11. New York, NY, USA: ACM, 2011.

- Wacker, Tobias. “Even the Most Basic Mobile Services Require Effective User on-Boarding.” GSMA, October 2017. https://www.gsma.com/mobilefordevelopment/programme/mhealth/even-basic-mobile-services-require-effective-user-boarding.

- West, Harry, and Rachel Lehrer. “Financial Inclusion for the Poorest Women in Pakistan.” January 10, 2014. https://www.slideshare.net/CGAP/financial-inclusion-for-the-poorest-women-in-pakistan.

- Wright, Graham A. N., Vera Bersudskaya, William Nanjero, Zeituna Mustafa, and Mercy Wachira. “Where Credit Is Due – Customer Experience of Digital Credit in Kenya.” MicroSave, March 22, 2017. http://www.microsave.net/resource/where_credit_is_due_customer_experience_of_digital_credit_in_kenya.

- Wyche, Susan, Nightingale Simiyu, and Martha E. Othieno. “Mobile Phones as Amplifiers of Social Inequality among Rural Kenyan Women.” ACM Transactions on Computer-Human Interaction: A Publication of the Association for Computing Machinery 23, no. 3 (June 14, 2016): 1–19.

Notes

& acknowledgements

Acknowledgements

Niamh Barry wrote this Snapshot with input from Jonathan Donner. This Snapshot was supported by the Mastercard Foundation.

Notes

The views presented in this paper are those of the author(s) and the Partnership, and do not necessarily represent the views of the Mastercard Foundation or Caribou Digital.

For questions or comments please contact us at ideas@financedigitalafrica.org.

Recommended citation

Partnership for Finance in a Digital Africa, “Snapshot 4: How do advances in digital finance interact with dynamics of exclusion?” Farnham, Surrey, United Kingdom: Caribou Digital Publishing, 2018. https://www.financedigitalafrica.org/snapshots/4/2018/.

About the Partnership

The Mastercard Foundation Partnership for Finance in a Digital Africa (the “Partnership”), an initiative of the Foundation’s Financial Inclusion Program, catalyzes knowledge and insights to promote meaningful financial inclusion in an increasingly digital world. Led and hosted by Caribou Digital, the Partnership works closely with leading organizations and companies across the digital finance space. By aggregating and synthesizing knowledge, conducting research to address key gaps, and identifying implications for the diverse actors working in the space, the Partnership strives to inform decisions with facts, and to accelerate meaningful financial inclusion for people across sub-Saharan Africa.

This is work is licensed under the Creative Commons AttributionNonCommercial-ShareAlike 4.0 International License. To view a copy of this license, visit http://creativecommons.org/licenses/by-nc-sa/4.0/.

Readers are encouraged to reproduce material from the Partnership for Finance in a Digital Africa for their own publications, as long as they are not being sold commercially. We request due acknowledgment, and, if possible, a copy of the publication. For online use, we ask readers to link to the original resource on the www.financedigitalafrica.org website.

-

Morawczynski and Pickens, “Poor People Using Mobile Financial Services.” ↩

-

Mirzoyants, “Mobile Money in Uganda The Financial Inclusion Tracker Surveys Project – Use, Barriers and Opportunities.” ↩

-

Totolo, “Kenya’s Digital Credit Revolution Five Years On.” ↩

-

Lonie et al., “The Mobile Banking Customer That Isn’t: Drivers of Digital Financial Services Inactivity in Côte d’Ivoire.” ↩

-

Rogers, Diffusion of Innovations. ↩

-

Rogers. ↩

-

Starting point texts: Andersson, Cuervo-Cazurra, and Nielsen, “From the Editors: Explaining Interaction Effects within and across Levels of Analysis.” ↩

-

Andersson, Cuervo-Cazurra, and Nielsen. ↩

-

Wyche, Simiyu, and Othieno, “Mobile Phones as Amplifiers of Social Inequality among Rural Kenyan Women.” ↩

-

Wyche, Simiyu, and Othieno. ↩

-

Jack and Suri, “Risk Sharing and Transactions Costs.” ↩

-

Ky Serge and Rugemintwari, “Does the Adoption of Mobile Money Affect Savings? Evidence from Burkina Faso.” ↩

-

Suri and Jack, “The Long-Run Poverty and Gender Impacts of Mobile Money.” ↩

-

Tichenor, Donohue, and Olien, “Mass Media Flow and Differential Growth in Knowledge.” ↩

-

Toyama, “Technology As Amplifier in International Development.” ↩

-

Schaner, “The Cost of Convenience?” ↩

-

Murendo Conrad and Wollni, “Mobile Money and Household Food Security in Uganda.” ↩

-

Romero and Nagarajan, “Impact of Micro-Savings on Shock Coping Strategies in Rural Malawi.” ↩

-

Cooper, “Intersectionality.” ↩

-

GSMA, “The Mobile Economy: Africa 2016.” ↩

-

GSMA. ↩

-

GSMA, “The Mobile Economy Sub-Saharan Africa 2017.” ↩

-

GSMA, “State of the Industry Report on Mobile Money: Decade Edition: 2006-2016.” ↩

-

de Reynal and Richter, “Stepping into Digital Life.” ↩

-

Johnson, Brown, and Fouillet, “The Search for Inclusion in Kenya’s Financial Landscape: The Rift Revealed.” ↩

-

McCaffrey and Ahimbisibwe, “Digital Finance and Illiteracy: Four Critical Risks.” ↩

-

West and Lehrer, “Financial Inclusion for the Poorest Women in Pakistan.” ↩

-

Wright et al., “Where Credit Is Due – Customer Experience of Digital Credit in Kenya.”) ↩

-

Francis, Blumenstock, and Robinson, “Digital Credit in Emerging Markets: A Snapshot of the Current Landscape and Open Research Questions.” ↩

-

Francis, Blumenstock, and Robinson. ↩

-

Anderson and Ahmed, “Smallholder Diaries: Building the Evidence Base with Farming Families in Mozambique, Tanzania, and Pakistan.” ↩

-

Wacker, “Even the Most Basic Mobile Services Require Effective User on-Boarding.” ↩

-

Arnold, “Women Mobile Phones and Savings – Grameen Foundation Case Study.” ↩

-

GSMA, “State of the Industry 2015: Mobile Financial Services for the Unbanked”; Shrader, “Digital Finance in Bangladesh: Where Are All the Women?”; Simanowitz, Banerjee, and Koning, “Customer Views on Customer Empowerment”; GSMA, “Unlocking the Potential: Women and Mobile Financial Services in Emerging Markets.” ↩

-

Bin-Humam and Ayes, “How Social Norms Affect Women’s Financial Inclusion.” ↩

-

Barrie, Khadar, and Gaydon, “Women and Mobile Money: Insights from Kenya.” ↩

-

GSMA, “State of the Industry Report on Mobile Money: Decade Edition: 2006-2016.” ↩

-

Hargittai, “Second-Level Digital Divide: Differences in People’s Online Skills.” ↩

-

Andersson, Cuervo-Cazurra, and Nielsen, “From the Editors: Explaining Interaction Effects within and across Levels of Analysis.” ↩