FiDA is publishing a mini series on various insights derived from an analysis of the latest Evidence Gap Map (EGM) update. This is the second blog, others will include impact insights on digital credit and payments and transfers, the design and delivery of various products, and where (people and location) we have been looking for impacts.

Previous blog: Launching the Digital Finance Evidence Gap Map 2.0

Saving is a sound financial practice, particularly for people with lower or fluctuating incomes. Savings help people cope with a poor harvest or a sick family member. Sufficient savings can secure the continuation of children’s educations or allow for the expansion or diversification of a business. Those who save may be rewarded with interest or, as they build a financial footprint, access to credit which—when invested in businesses or income-generating assets, can increase earnings.

As simple as it is in theory, many struggle to save effectively. There are several challenges to overcome such as limited discretionary income, fee sensitivity, access to and availability of appropriate savings products, and savings habit formation.

While numerous studies report the impact of various analog approaches to improving savings behavior and the longer-term results of savings, we focus on if and how ‘digital’ has improved savings behavior among low-income populations.

What are the insights so far?

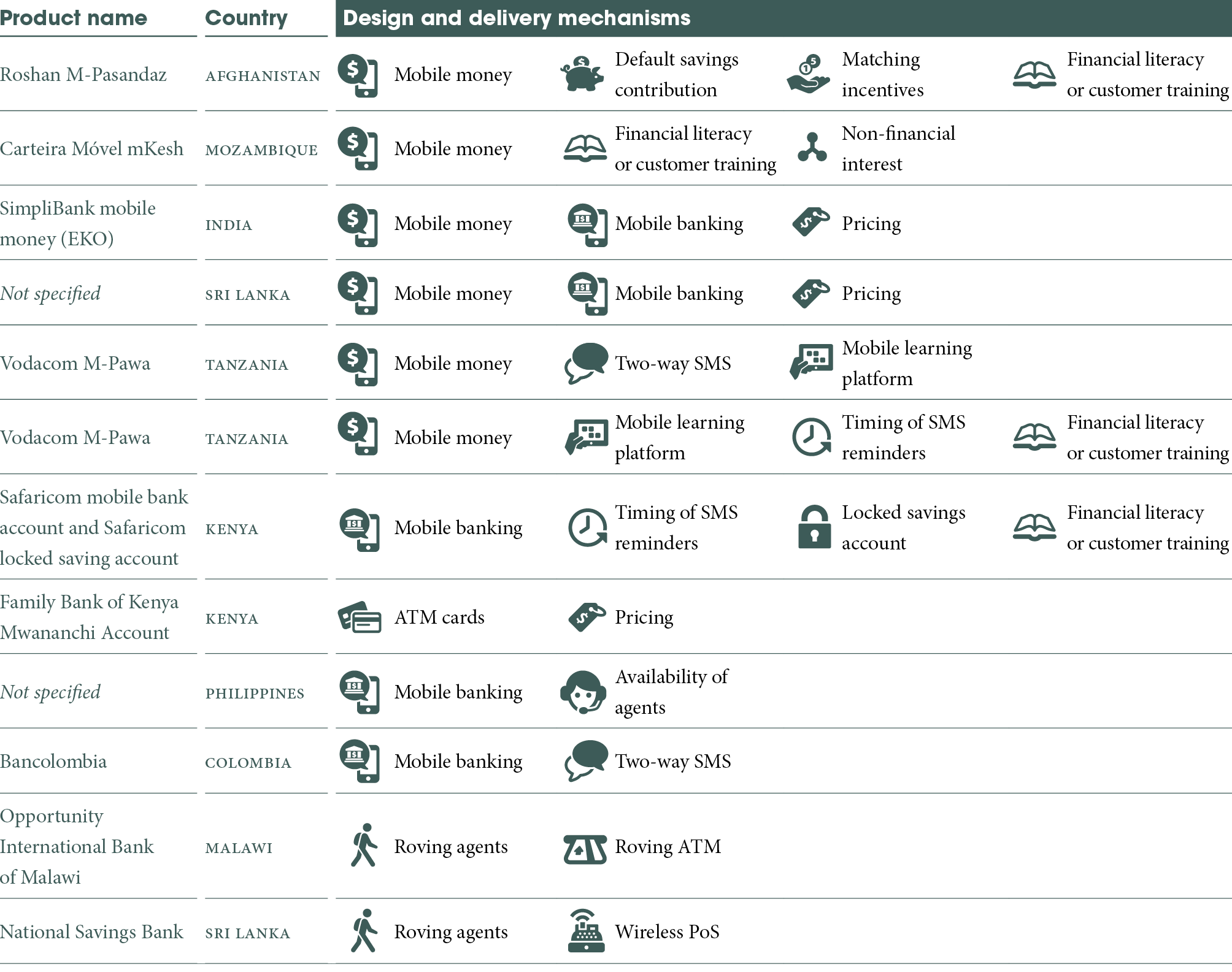

The EGM includes just 12 studies that evaluated the effect of digital savings products (in 9 countries). It is early in terms of the quantity of insights. Accordingly, we should be cautious about drawing conclusions or rendering a verdict. With the exception of the Tanzanian studies on M-Pawa, these 12 studies involved different markets, client groups and design and delivery mechanisms. The table below illustrates the diversity of the digital savings products that were examined.

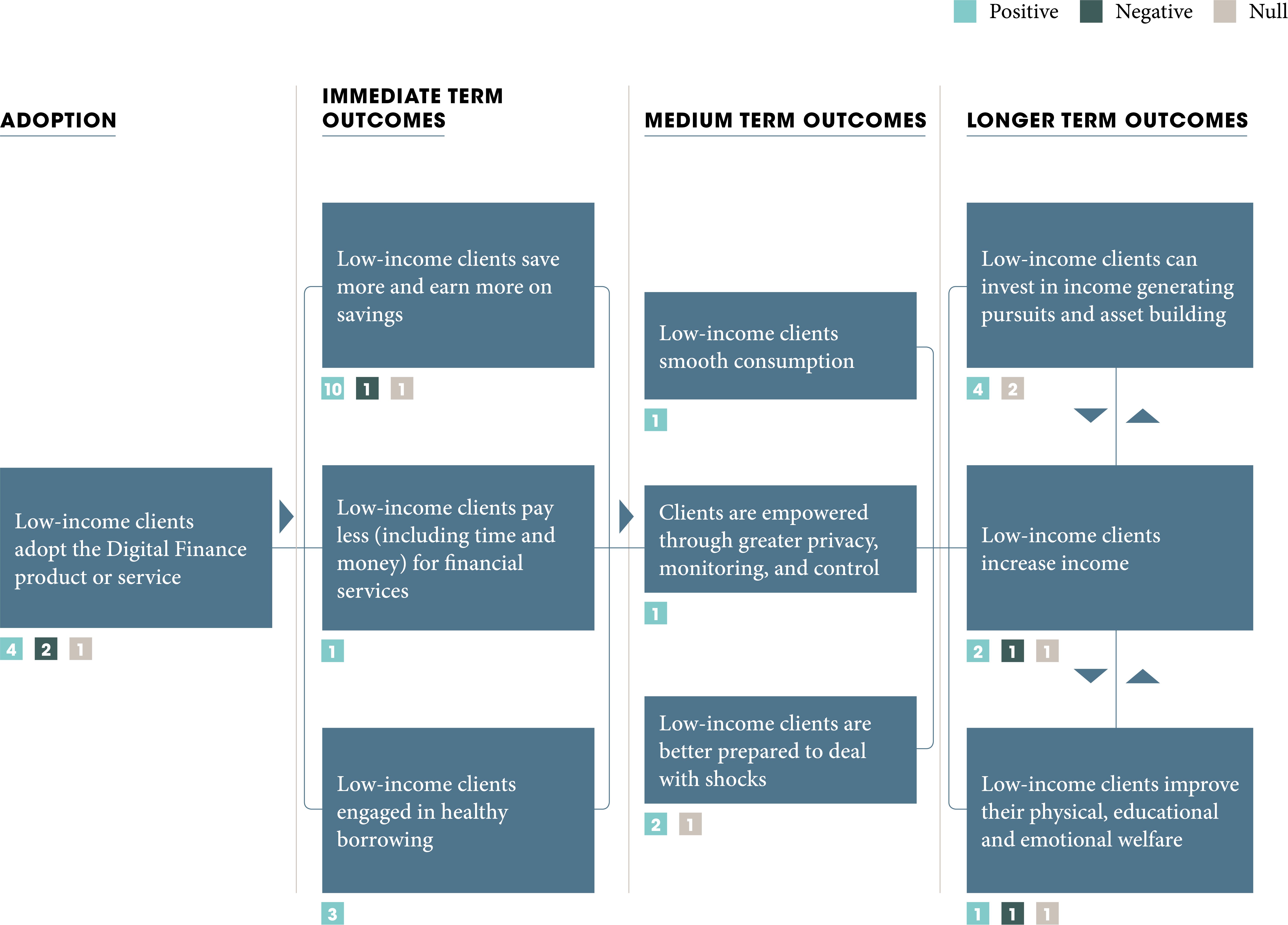

These 12 studies, entail 41 outcomes tests. The diagram below, shows the outcomes tested, and the number of studies that had a positive, negative, or null effect. Positive, negative, and null effects have been observed on client outcomes both across the studies and within a single study. This is indicative of the early stage of testing and learning on digital savings. Over time—with the support of investors, donors, practitioners, and researchers—more products will be developed and tested. As we continue to synthesize the evidence, clearer patterns may emerge and eventually allow us to uncover best practices.

Spotlight on selected savings studies

We highlight a selection of insights from our analysis of the studies within the EGM and invite digital savings practitioners, researchers, donors, and policymakers to interact with the EGM to derive insights that match their needs and questions.

Interactive learning and nudges

- In a CGAP supported experiment, M-Pawa—an interest-bearing mobile money savings account that also provides micro loans conditional on savings performance—partnered with Arifu, a mobile learning platform, to improve savings and borrowing behaviors among smallholder farmers. Using two-way SMS on financial literacy content, the intervention observed that if a customer ever interacted with Arifu, they had a larger number of transactions compared to non-Arifu customers (0.64 more). Additionally, interaction with Arifu’s content led customers to have larger running balances (4,447 TZS/$1.94 more).

- The Technoserve Women in Business program also partnered with Arifu and M-Pawa to trial two interventions meant to improve business outcomes for female micro entrepreneurs. The M-Pawa intervention provided an M-Pawa training session and allowed clients to set savings goals and receive weekly savings reminders through Arifu. The business intervention included the M-Pawa training session in addition to business skills training. The results showed that women in the M-Pawa group saved three times more than women in the control group, while those in the M-Pawa plus business training group saved almost five times more. The intervention increased the probability of receiving a loan by 14 percent. Regarding business outcomes, the study found that the intervention did not have an impact on business survival. There was, however, evidence that the intervention led to business expansion when combined with business training. Here, women were 4.6 percent more likely to operate a secondary business and generate a small increase (4,000TZS/$1.74) in monthly profits.

- Bancolombia tested two-way SMS, in partnership with Juntos Finanzasto improve savings balances among their clients. Three months after the introduction of two-way SMS, active new accounts increased by 32.5% and average account balances increased by 50%.

Bringing digital to the door

- Sri Lanka’s National Savings Bank piloted weekly, door-to-door savings deposit collection services to a randomly selected sample of individuals in rural areas using a wireless point of service (POS) terminal. The weekly visits generated an increase in the frequency of transactions, which quadrupled from a control average of .5 transactions per month to an average of more than 2 per month, and overall savings increased by 15% per month.

- Opportunity International Bank of Malawi deployed roving agents equipped with a mobile ATM to provide savings services to rural areas. It was expected that access to formal savings services would help households cope with adverse shocks by reducing their use of sub-optimal coping behaviors such as depleting assets. However, the results indicated that having an active savings account did not result in a reduction of sub-optimal coping behaviors. However, the study did find differential levels of impacts based on wealth. For wealthier households, an increase in savings was associated with less reliance on asset depletion. But, the effect was the opposite for less wealthy households.

Variation in types of savings account:default, commitment, and locked

- In partnership with Safaricom, researchers piloted the use of a mobile banking account (MBA) and a locked savings account (LSA), to encourage parents to save for the transition to secondary school. Balances on the LSAs earn a bonus of 1% additional interest, which is forfeited if funds are withdrawn early. The two savings interventions were promoted to parents, in addition to a control, at the school level. Estimates suggest that being induced to open an MBA increased bank account savings by between 1,000 and 1,500 KES ($10-$15), and being induced to open an LSA increased them by about 500 KES ($5). Parents in both treatment groups were between 3% and 5% more likely to access an MBA loan. Further, use of the MBAs and LSAs was shown to boost school enrollment regardless of the analysis used; opening a bank account was associated with a 27% to 40% boost in school enrollment.

- In Afghanistan, assigning a default contribution was found to increase employees’ savings contributions. The study found that employees who were assigned a default contribution rate of five percent were 40% more likely to contribute to the account six months later compared to individuals who were assigned a contribution rate of zero. However, while default contribution was found to increase employees’ savings contributions, no effect was noted on a well-being index which included measures such as nights without food, life satisfaction, and physical health.

- In Mozambique, researchers partnered with mKesh to optimize the mobile money channel as a commitment savings device for smallholder farmers. The savings treatment was based on the offer of a bonus of 20% interest for the average mKesh balance held by an individual before planting season.This bonus was paid in fertilizer. The treatment group also received training on mKesh and fertilizer use as well as a mobile phone. In the first year, the farmers’ average daily savings in mKesh increased by 38% to 44%. Looking at agricultural inputs, statistically significant effects were noted for fertilizer use and owning irrigation pumps.

Overlaying digital elements on a traditional banking service

- The Family Bank of Kenya tested the effects of ATM cards to boost transactions. ATM cards would reduce the over-the-counter withdrawal fee by 50% and allow for out of hours withdrawals. The ATM cards led to a 68% increase in transactions over two and a half years and increased the value of deposits and withdrawals. However, while the ATM cards had positive effects on joint accounts and accounts owned by men, it decreased the use of female owned accounts. Researchers hypothesize that women were less incentivized to save when their partner could access their account via their ATM card.

The full 360—changing an analog savings service to a digital savings service

- A bank in the Philippines piloted a mobile banking system for savings and credit. Previously, members deposited through regular village meetings with bank agents and withdrew at bank offices in town centers. When mobile banking was introduced, members individually made repayments, deposits, and withdrawals through corner stores for a fee. The introduction of mobile banking resulted in a 20% decrease in the average daily balance and a 25% decrease in the likelihood of weekly deposits. This was more pronounced for members who had previously lived close to the bank or village meeting point. A follow-up survey suggested that the decline in savings was driven by the weakened peer effect provided by group banking and increased fee sensitivity. Despite the negative effects, mobile banking did increase the convenience of transactions. Estimates suggest a 30% reduction in the amount of time taken for deposits and 70% for withdrawals.

The takeaways

While we are far from a conclusion, digital savings practitioners, donors, and investors should note the following insights as they further develop and test savings products:

- Two-way SMS and mobile learning platforms have been shown to enable better savings behaviors

- Coupling the introduction of savings products with client training—either through digital platforms or traditional modes—appears to bolster clients’ ability to optimise the use of savings in the longer term.The effects of simply providing the savings products on longer term outcomes, is less certain.

- Incorporating digital elements into existing traditional financial services such as ATM cards or roving agents with POS technology has been shown to improve access to savings products and savings behavior.

- A total change from an analog service to a digital service needs to consider the positives of the analog service (such as agent interface and peer effects) and carefully design for the transition.

- Default contributions, locked savings accounts, and commitment savings accounts were all found to improve the savings behavior of clients, and when client training was provided, longer-term effects on welfare were observed.

- Product design needs to carefully consider the potential differential effects on, for example, women and men, higher and lower incomes, rural and urban, etc. There are cases where some groups benefit more than others.

Researchers, and those who fund research, have a crucial role to play in partnering with digital savings practitioners, articulating robust theories of change for a product, and testing those theories. There are clear gaps in outcomes, products, markets, and, particularly, the client segments tested.

The insights gathered thus far are encouraging and, as a community, we should continue to look for opportunities to gather evidence on the effects of digital savings products.

The studies in the EGM, represent our best knowledge of digital finance impact insights. New studies are ever emerging and thus the EGM will continue to evolve. If you have questions on the EGM, are interested in discussing research priorities, or know of relevant Digital Finance impact studies that meet the inclusion criteria, please contact ideas@financedigitalafrica.org.