What we know

Although the landscape of digital financial services (DFS) is broader than mobile money, mobile money spearheaded and serves as the foundation of the digital finance revolution we are witnessing today. As of 2016, there were 277 live mobile money deployments across 92 markets, including two-thirds of low-income and middle-income countries.1 Moreover, registered accounts have grown at least sixfold since 2011 to half a billion in 2016.2 The telecom industry is rightfully credited with the majority of that success, which it achieved through a nationwide network of retailers and a large GSM base of customers who could register for mobile wallets. Mobile network operators (MNOs) ran or operationalized 69% of services launched in 2015 and 58% of all live services are MNO-led. 3

However, a competitive landscape is beginning to grow as other players launch their own products. For example, there are now successful bank-led models in Kenya and Pakistan. According to the Helix Institute of Digital Finance, Kenyan agency banking’s market presence grew threefold between 2013 and 2014— from 5% to 15%.4 This aggressive expansion was led by Equity Bank, which single handedly grew its market presence from 1.3% in 2013 to 8% in 2014.5

Third party models—purposely built to provide DFS—are also thriving. Zoona in Zambia and bKash in Bangladesh both have the largest share of market presence in their respective countries;6 bKash, for example, serves over 24 million customers.7

Although the majority of services still focus on person-to-person (P2P) transfers and payments—airtime top ups and P2P accounted for 81% of transaction volume and 74% of value in 20168—providers in many markets are moving toward other digital finance use cases, such as bill pay for pay-as-you-go energy solutions (PAYG) as well as savings, credit, and insurance products. However, as discussed in Snapshot 1, the uptake of these sophisticated services has been slower than hoped.

This Snapshot will focus on the steady change in the landscape of digital commercial offerings, with particular emphasis on the rise of digital data trails and alternative lenders. We will also discuss business case considerations for digital finance providers, stressing that implementing DFS requires foresight, patience, and commitment.

The heart of a digital finance deployment is its value proposition

In 2007, Safaricom M-PESA found a compelling value proposition for its customers with their P2P campaign “Send Money Home,” solving a pain point experienced by many within their target market. Since then, P2P services have multiplied globally. Building on this foundation, digital finance providers have attempted—and in some cases struggled—to address additional financial service needs. As suggested by Ignacio Mas, perhaps the reason that success with other services has been elusive is because some offerings face a “relevance barrier” by not designing the “right-sized products and services” for customers.9

The value proposition—the products and services that a digital finance provider delivers to its customers—is the heart of any deployment. The deployment’s artery is thus a clear strategy based on the relevance and purpose of the service and a defined customer segment. If DFS providers do not align their value proposition with their business model and delivery channel, they will struggle to generate revenue.

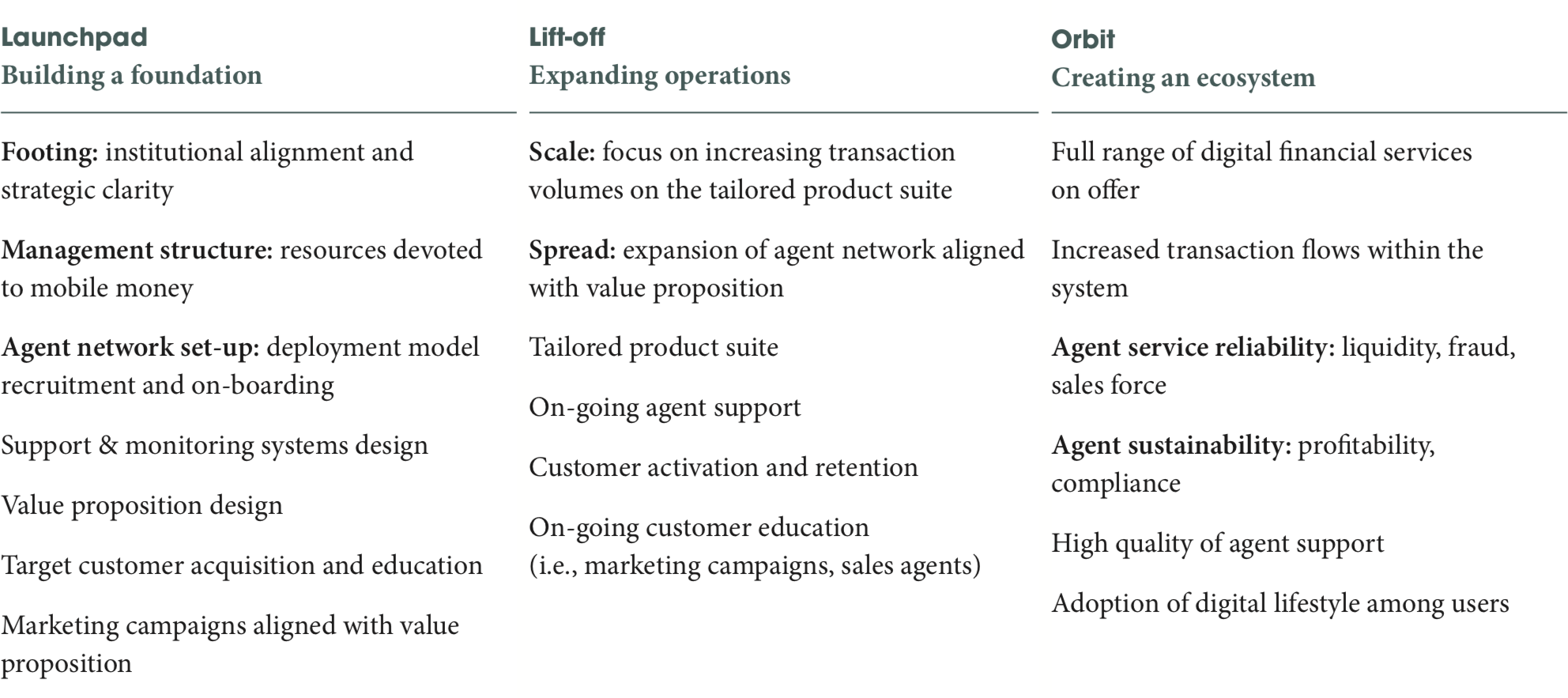

The Helix Institute of Digital Finance found that while many providers set up expensive and expansive mobile money agent networks aimed to deliver scale—i.e., high volume and low value mobile money transactions—providers skip the foundational step of clearly defining their value proposition for both their customers and agents.10 Providers should ideally undergo three growth stages (outlined in figure 1) in order to reach their full potential: launchpad, lift-off, and orbit.11

The Launchpad Stage concentrates on ensuring that the strategic foundation is laid perfectly, such as by clearly defining strategic objectives and management structure, before rolling out a DFS deployment. With the foundation cemented, the focus shifts to expanding operations. The Lift-off Stage includes increasing transaction volumes on the tailored product suite in order to target customers and expanding delivery touch points at strategically chosen places.12 Once the market reaches maturity—often many years later—providers can center on the Orbit Stage by building a digital ecosystem. While this Snapshot illustrates the innovative services that are being rolled out, the most advanced DFS providers have not reached lift-off yet.

Figure 1: Three Stages of Development for a Digital Finance Deployment

Source: Growth framework developed by the Helix Institute of Digital Finance

The product mix has expanded, but value propositions are not always aligned with customers’ needs or market conditions

The penetration and success of additional financial products, such as bill/merchant payments and bulk disbursements, has been mixed. Merchant payments have struggled to gain traction; they account for only 5% of the volume of transactions and approximately 5% of the value of transactions in 2016.13 The value proposition for merchants to accept digital payments is still developing and needs to fit local market criteria such as banking infrastructure (card or wallet based), customer preferences and behavior around digital wallets (large or small balances), and norms around payments to suppliers (cash or other methods).14 Globally, the majority of merchant payments are driven by the relatively small number of deployments that have managed to address these challenges. The top five merchant payments services accounted for little more than three-fourths (77%) of all merchant payment transactions in December 2014. 15

Moreover, although bulk disbursements experienced one of the fastest growth rates in terms of value— increasing 48% in 2015 “and translating into inflows worth $670 million”16—they only comprised 2.2% of the total volume of transactions in 2016.17 In 2015, Government payments led the way within the category of bulk disbursements (social transfers, salary, and pension payments): about two-thirds of bulk disbursements were government-to-person (G2P), followed by business-to-person (B2P) at almost a third (32%), and donor-to-person (D2P) at 3%.18 The relative success of G2P payments compared to the other bulk disbursements could be due to a few factors:

- From a government perspective, electronic transfers of large social cash transfer programs can help reduce administrative costs and leakage due to fraud along the way, and thus some governments, such as in Pakistan and Colombia,19 have implemented digital cash-transfers.

- For a provider, G2P often represents significant payment volumes, prospective new customers, and an additional source of revenue.

- Lastly, digital delivery of cash transfers is convenient and safe for beneficiaries, and it can have the added benefit of giving mobile-enabled but unbanked beneficiaries access to finance.

In practice, however, emerging evidence indicates that the success of G2P is mixed20—which partially explains the overall low volume of transactions in 2016. Digital finance providers report that the profit margins on G2P electronic payments are so small that few institutional resources can justifiably be spent on leveraging the payments for additional financial products and inclusion.21 Beneficiaries do not necessarily find the digital channel more convenient and withdraw all received funds immediately; additionally, beneficiaries still report long lines and technical problems.22 Lastly, while electronic transfers have reduced leakage, government procurement processes can be painstakingly long. These challenges reflect the fact that although G2P payments have the potential to address the needs of its beneficiaries and customers (governments), DFS providers still need to create tangible incentives for both customers and beneficiaries in order to take G2P payments to a significant level.

Recently, however, providers have begun leveraging digital technology to better understand clients’ needs and how they interface with financial products. This has led to alluring use cases beyond payments (see Learning Advances of Digital Finance 2017). Frequently, providers introduce these sophisticated services through new modes of engagement that take advantage of innovative digital attributes and thus slowly change the landscape of digital finance commercial offerings.

The Advent of Digital Data Trails

As defined by CGAP, “Digital attributes”23 are advanced characteristics of digital, particularly mobile, that enable DFS beyond a basic mobile wallet. Although smartphones encompass the full range of digital attributes (such as real-time interaction and digital data trails), feature phones still avail some of these attributes. Digital attributes are having a profound effect on the landscape of DFS. For example, digital data trails24 have enabled alternative lenders to emerge on the scene in sub-Saharan Africa by leveraging non-financial data as a source of information about potential clients.

Alternative lenders now represent a growing sub-sector of digitally-based lending platforms for different borrowing needs, including consumer, micro, small, and medium enterprises (SMEs). By providing a digital end-to-end loan experience—from application and origination to underwriting and servicing—alternative lenders are able to perform the credit underwriting process and approve (or decline) a loan application based on the borrower’s risk score in near real time. Increasingly, alternative lenders use algorithms that rely on non-financial sources of underwriting data, such as mobile phone usage (SMS, voice, mobile apps). Tala is one such company that uses non-financial data for credit scoring. The instant credit Tala provides customers is based on a customer’s digital interactions on their smartphone as well as non-digital data such as self-reported income and motivation for a loan. Moreover, organizations like Lendable are helping alternative lenders grow by providing them with analytics and connections to sources of capital.

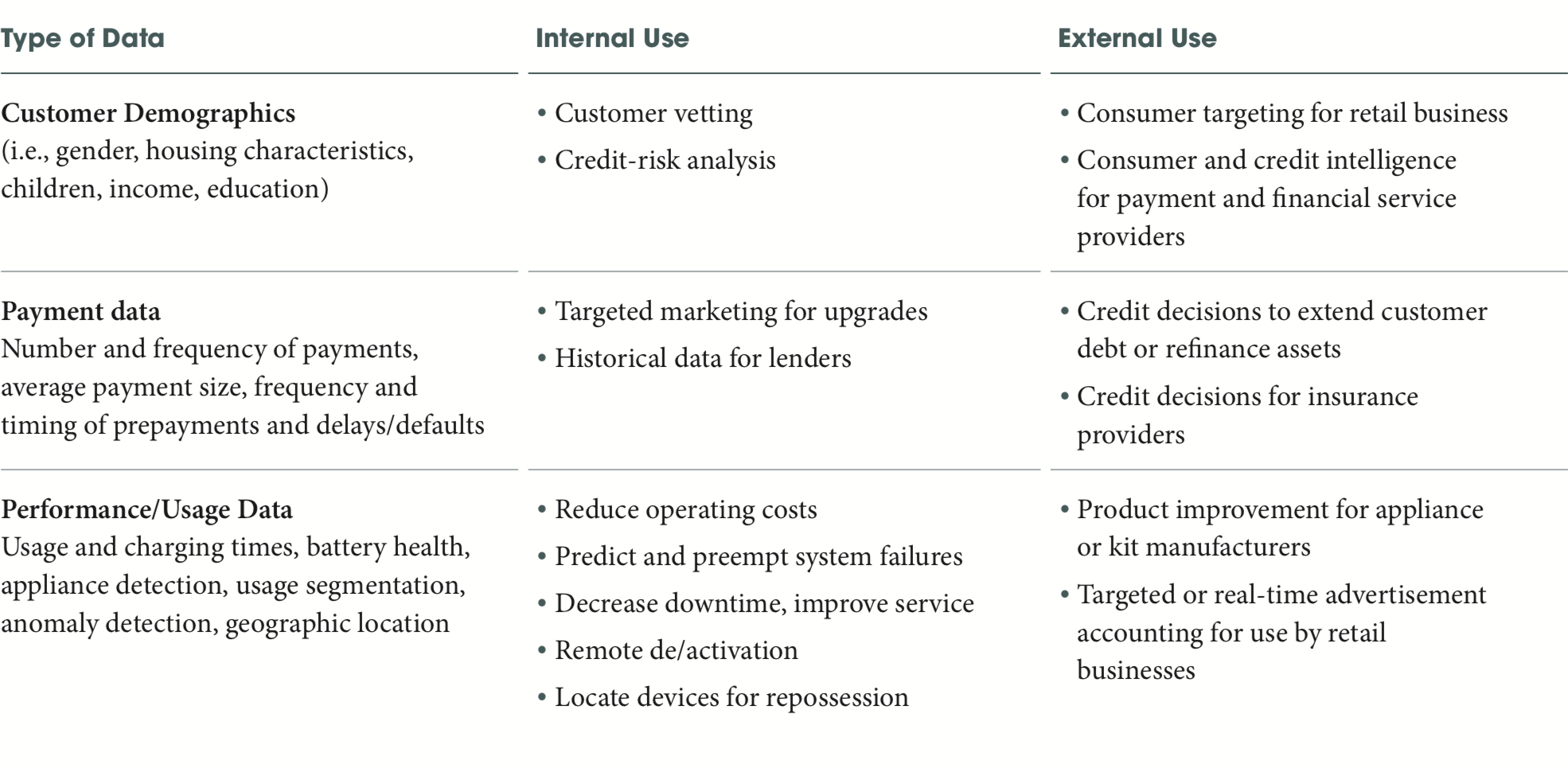

PAYG energy providers are another type of alternative lender that have developed innovative financing mechanisms to allow low-income clients access to basic services such as energy, water, and education. They are leveraging digital data trails to improve customer segmentation and payment behavior through “real-time performance monitoring, produc[ing] a huge dataset that is well suited to advanced analysis.”25 Customer demographic data, for example, can be used to vet customers and analyze credit risk for internal purposes. Table 1 highlights the multiple layers of data employed to analyze customers’ behaviors and needs. Analyzing these data allows providers to build products around customers’ behaviors and needs, such as payment data that serves as internal historical data for lenders and as external data for credit decisions by insurers. Further, performance data can be used internally to predict and preempt system failures as well as help kit manufacturers improve their products for customers.

Table 1: Datasets available to PAYG companies

Source: Bloomberg New Energy Finance

MNOs are also leveraging digital data trails, tapping into their own records about mobile phone and mobile money usage to assess creditworthiness, assign individual credit limits, and lend to customers. Indeed, for some providers, this has led to innovation in lending products with a value proposition around fast and convenient initial credit-scoring decisions. One such example is M-Shwari in Kenya, a combined savings and loans product launched in 2012 through a collaboration between the Commercial Bank of Africa (CBA) and Safaricom. The companies developed a credit-scoring analysis based on a client’s use of M-PESA and Safaricom airtime and data. By the end of 2014, M-Shwari had disbursed KES 20.6 million in loans to 2.8 million borrowers, with a non-performing loan rate of 2.2% (after 90 days).26

Show me the money: Business case for MNOs and banks

Different types of digital finance deployments will come with different objectives—from decongesting a bank branch and extending the bank’s rural footprint, to upselling an MNO’s customer base to digital finance. Once providers have decided on their deployment’s objectives and direction, a critical step for every deployment, they must ensure that a business case is in place, including necessary changes to the business model for the deployment.

The following subsection focuses on the business case, highlighting industry experience thus far in achieving profitability while bearing in mind that establishing and maintaining a digital finance deployment is expensive and requires both commitment and patience. Because agency banking and third-party experience is relatively recent and therefore less documented, the majority of examples we highlight come from MNOs. FiDA’s Snapshot 11 “What ecosystems improvements will unlock investment in digital finance?” discusses the challenges in securing the necessary investment capital—whether internally or externally—for digital finance deployments or startups in more detail.

In the case of MNOs, indirect benefits or adjacency (non-financial service revenue) has historically been a major business driver for launching or expanding DFS.27 These benefits typically fall into three categories: savings on airtime distribution,28 increased airtime and SMS sales, and reduced customer churn.29 Safaricom, for example, generated an estimated EUR 1.29−EUR 4.50 profit per customer from churn reduction and reduced distribution costs through its ownership of M-PESA (2013).30 Moreover, less than 4 years after Telesom ZAAD’s launch, 70% of its airtime was being sold over mobile money, amounting to a $2 million savings (2012). 31

More recently, MNOs have focused on generating profits in the long term from a combination of direct fee revenues in addition to the aforementioned indirect benefits. While Safaricom generates approximately 20% of its revenue from M-PESA,32 most deployments are still earning less from direct revenues. According to the GSMA 2015 State of the Industry Report, 72% (31 of 43) of MNO-led respondents reported earning more than 1% of total revenues from mobile money in 2015, although encouragingly, a little over a quarter (25.6%) of the MNO-led (11 of 43) deployments reported earning more than 10% of total revenues from mobile money.

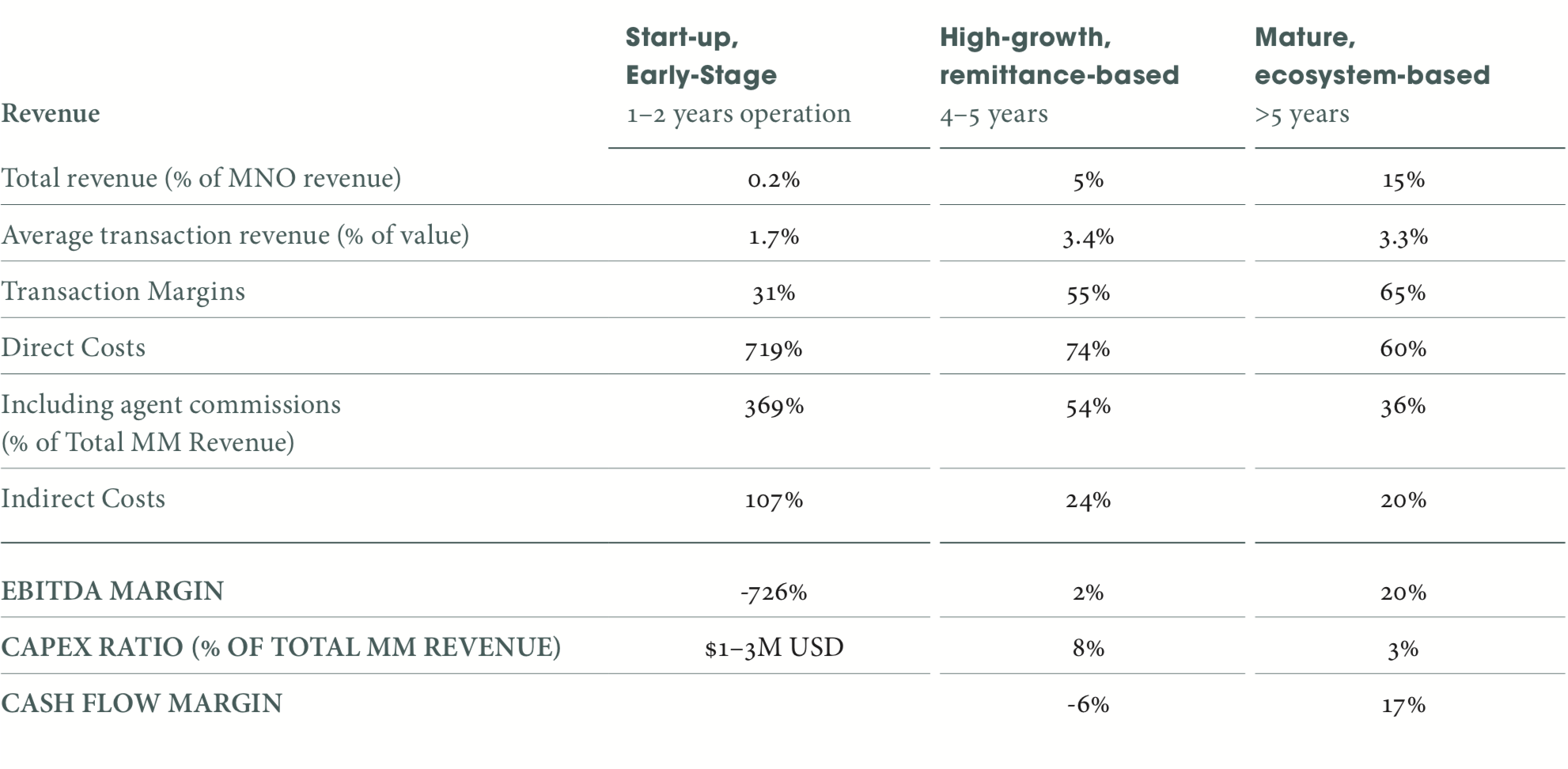

The key to achieving significantly greater profits is reaching scale.33 Mobile money is first and foremost an OPEX business, driven by agent commissions, marketing, and personnel expenditures.34 GSMA reports that in the start-up phase of a mobile money business, MNOs should expect to invest six to eight times the revenue units generated by mobile money.35 Safaricom reportedly invested over $30 million in M-PESA.36 These deployments need time and resources to build agent networks and to enroll and educate customers. Research suggests that even successful deployments require three to five years to reach profitability.37 For example, Telenor Pakistan invested $7 million in its technology platform, national marketing campaign, organizational structure, and agent training to launch Easypaisa in 2009; four years later, Easypaisa broke even.38

When markets become more mature, however, MNOs can expect positive margins of more than 20%—as illustrated in Table 2 below—as the ratio of digital to cash-based transactions widens.39 These estimates do not include the potential financial gains from adjacent revenue pools, such as credit scoring services and other data analytics for mobile money usage, or the new products enabled by a mature ecosystem. Indeed, highly successful deployments can grow to even greater profitability margins through these types of expansions.40 For example, Vodacom reported that M-PESA in Tanzania accounted for 22.6% of service revenue in 2015,41 seven years after its launch. In March 2017, Safaricom reported that M-PESA’s revenue had reached 32% (KES 55 billion), accounting for a quarter of Safaricom’s KES 213 billion revenue.42

Table 2: Summary of Key Performance Indicators (KPIs) for Three Mobile Money Scenarios Along the Journey to Profitability (2014) 43

Source: GSMA

While agents are an essential delivery channel for mobile money operators, profitability comes from large numbers of active customers leveraging electronic services and fewer live agent services

DFS agents are the first touchpoint for many customers. As such, agents have the ability to make or break a customer’s experience. Providers must strike a complicated balance to ensure their agents are profitable without bleeding out their own margins, as experienced in the OTC dominated market of Pakistan. In 2013, GSMA reported that mobile money providers in Pakistan paid approximately half of their transaction revenues to agents through commissions (infamously known as the “commissions war”).44 As of 2017, Pakistani agents earned $264 (PPP adjusted) per month, which is significantly higher than what agents in the mature wallet-based market in Kenya were earning in 2014: $220 (PPP adjusted).45 Even for Safaricom, a few years earlier in 2013, agent commissions were reported as the biggest contributor of direct costs to their business: $60 million within 6 months of the reporting year.46

Active customers, especially active customers leveraging electronic-only transactions, contribute significantly to direct revenue growth and profitability. Indeed, CGAP notes that one of the key drivers of direct revenue is growth in active customers.47 A high number of inactive customers means that more transactions are expected from each active customer for the business to turn cash flow positive.48 Further, CGAP argues that to see rapid growth in profits, MNOs need growth in transactions per month per active customer. Research has indicated that M-PESA Kenya earned an estimated 18% weighted average gross margin on agent-based transactions compared with almost 100% gross margin on electronic-only transactions. M-PESA Kenya’s “electronic-only” transactions grew 35% faster than agent transactions.49 Moreover, M-PESA reported a 20% growth in 30-day active M-PESA customers to 16.6 million active users in 2016 (compared to the previous year) with 7.4 chargeable transactions per active customer.50

Banks rely on a different business model to reach profitability in digital finance

A traditional bank’s business model is dependent on collecting revenue on interest and deposits, unlike the mobile money model wherein revenues are fee-driven. A bank’s motive in offering digital finance is typically to extend their footprint beyond branches and/or reduce traffic at their branches. They can’t necessarily rely on adjacency. Rather, most employ a usage-based model (although there is no consensus on the effectiveness of this model51), which entails generating revenue from transactions and earning interest on float or lending products.52

Nonetheless, some industry analysts argue that banks can rely on adjacency revenues, offering services beyond a basic account such as insurance and credit.53 Research found that savings accounts with low balances were profitable when other products were added (one to two products can yield positive gross margins for both bank and business correspondent by the third year of operations).54 An example could be savings, remittance, insurance, credit, and EBT supplemented by mobile top-up or rail/bus tickets.

Moreover, there is evidence that adjacency strategies can yield profits for banks, as exemplified in Kenya. The Commercial Bank of Africa (CBA) projected breaking even within 22 months of M-Shwari’s launch. Because of the immense interest in their savings and loan product, CBA fully paid back their initial investment and recurrent costs within 17 months.55

Notable new learning

Smartphone connections in sub-Saharan Africa doubled between 2014 and 2016 to nearly 200 million (a quarter of mobile connections), resulting in greater numbers consuming digital content via mobile devices.56 A growing trail of digital data per consumer is mushrooming the competitive landscape with the emergence of a multitude of new digital finance providers. Moreover, as smartphone penetration is increasing, airtime revenue for MNOs is trending downwards due to users shifting some consumption to data and Wi-Fi. In sub-Saharan Africa, several MNO’s have altered their strategies in the face of this decline in airtime consumption in order to stay relevant in the booming digital age of large internet platform players like Facebook, WhatsApp, and Google.57

One of the biggest threats MNOs face at present is the widespread adoption of over-the-top (OTT) messaging platforms. GSMA’s Global Mobile Engagement Index (GMEI) found that up to 90% of smartphone users in Nigeria, South Africa, and Tanzania regularly use at least one IP messaging service, such as WhatsApp, BBM, or Facebook Messenger.58 The use of IP messaging services suggests that customers may be relying less on traditional SMS messaging and voice calls.

However, as messaging platforms increase the number of services—such as music, gaming, and payments—available through bots or other features on the platforms, there is potential for MNOs to profit. According to the GSMA, the user base for major IP messaging services is expected to reach 4 billion by the end of 2017—a larger base than the entire social media market today.59 MNOs are positioned to play a core role in the value chain if they can deploy Messaging as a Platform (MaaP) services and develop a wider ecosystem to further develop and better deliver conversational commerce, customer service, and other chatbot or plugin applications.60 MNOs can also potentially play the role of a chatbot store and distribute content across their networks. To be successful, MNOs will need to foster strong partnerships and collaborations with existing internet platform players as well as newcomers.

MNOs and others developing a platform strategy around messaging and conversational interfaces can benefit from the example of platforms that have already achieved this sort of integration. For example, China’s WeChat messaging platform integrated other services for its customers, such as a popular payment feature (WeChat Pay).

Moreover, entertainment content is already viewable through messaging platforms and can contribute to data connection revenues. In 2016, MTN Group reported 44% growth in revenue from digital content services, with the number of music and gaming subscribers rising to 4 million and 5.4 million, respectively.61 Real-time entertainment (both video and audio) accounted for 18% of downstream mobile internet traffic in Africa in 2015, up from almost 9% the previous year.62 Local platforms such as IROKOTv and Bozz are challenging the larger, international platforms and collaborating with MNOs to enable technical features that can improve price points as well as increase their target audiences. As more content moves to messaging platforms with simpler interfaces for search and discovery, the opportunities for MNOs to generate revenue via this trend will increase.

Are business models transforming?

Faced with the looming threat of internet platform players and decreasing revenues from their core business strategy, MNOs and some of the larger banks are future proofing themselves. A decade ago, mobile money itself was a diversification strategy: a means to drive business back to core GSM services or, for smaller MNOs, to increase their share of GSM services. Now, the diversification strategy of MNOs with mobile money deployments revolves around products and services that leverage their mobile money deployments to help drive increasing mobile money revenues.

Providers are, or soon will be, monetizing new products and services directly through revenue sharing agreements with partners. In an upcoming Snapshot, we will focus on the role of partnerships in the growing digital finance landscape and the implications of this trend for traditional digital finance providers and their business models.

New types of players are collaborating with digital finance providers

FinTechs and other technology start-ups stand to benefit from collaboration with banks and MNOs, and vice versa. Banks and MNOs can leverage start-ups’ ability to rapidly innovate, while start-ups can make use of traditional digital finance providers’ reach and resources to achieve greater scale.

Commercial offerings developed via partnerships can extend to all sectors—agriculture, education, transportation, utilities, etc.—and already providers are seeing success with this strategy. Econet Zimbabwe’s diversification away from mobile money to solar energy, agricultural information, financial services, and digital school material together contributed to 11% of its overall revenue in the first half of 2015.63 Safaricom, the Kenyan mobile money giant, partnered with Craft Silicon to introduce Little Cab in 2016, rivaling Uber’s ride-hailing services in Kenya. Both riders and drivers can use Safaricom’s M-PESA payment platform to pay/be compensated for the trip. Four months after its launch, Little Cab had managed to recruit 1600 drivers, well exceeding Uber’s pool of 1000 drivers at the time, even though Uber launched in Kenya a year ahead of Little Cab.64 Research suggests that Little Cab has gained traction because it is cheaper for passengers than Uber and offers drivers a higher share of revenues. Safaricom and Craft Silicon plan to launch the service in Nigeria and Uganda in 2017.

Recently, Safaricom also expanded into the retail sector with the launch of Masoko, its e-commerce platform. Masoko debuted in November 2017 just in time for Black Friday, a day when, globally, retailers offer significant discounts. The primary payment option on the platform is Lipa Na M-PESA, which runs on top of M-PESA’s new API. Sendy, a local delivery and logistics platform, facilitates the last mile distribution of products purchased through the platform.65 Masoko is competing with already established e-commerce platforms such as Jumia and OLX. However, Jumia notes that because online buying behavior has not picked up in Kenya, the launch of Masoko will raise awareness of the possibility of online buying and its associated platforms.66

Additionally, Vodacom has launched a series of Internet of Things (IoT) services across the region, including a Stock Visibility Solution, which provides real-time visibility of stock levels at primary healthcare dispensaries in South Africa. In 2016, Vodacom’s IoT connections and revenue grew 28% and 21% to 2.3 million and ZAR 556 million ($42 million), respectively.67

Banks, too, are launching new strategies in the booming digital era of large internet players

In late 2016, Kenya Commercial Bank (KCB) announced its plan to launch its new unit, KCB FinTech, in mid-2017 and is in conversation with Alphabet, Tencent, Facebook, Apple, and Alibaba. The company wants to have 20 million customers by the end of 2018.68 The company is also in talks with PayPal, Samsung Electronics, and Twitter. “This is the journey we are going through,” said Chief Digital Officer Edward Ndichu, who will lead the KCB Fintech unit. “We need to benchmark with the needs of the customer.”69 Moreover, in 2016, Equity Bank announced a new strategy to focus on digital banking services, with plans to spend KES 20 billion ($192 million) on their new IT platform over the years.70 These two moves are encouraging and indicate a shift in banks’ traditional mindset. Furthermore, this suggests that some large financial institutions are willing to innovate in the face of the changing digital landscape.

At the same time, it is important to note that the majority of banks in sub-Saharan Africa have not adequately and thoughtfully invested in digital strategies. This may be because banks still exercise competitive marketplace power in some markets (see Learning Advances of Digital Finance 2017). Additionally, bank culture is generally a barrier to innovation, and many banks are not convinced that they can profitably lend to low-income segments.

Outside sub-Saharan Africa, some banks are quickly taking advantage of the global shift to digital. In 2015 the Reserve Bank of India (RBI) mandated licensing for a new type of banking service provider: payment banks.71 The objective is that payment banks will service hard-to-reach populations such as migrant workers and rural populations that typically shy away from banking. While payment banks cannot offer term deposits or credit, they do offer ATM and debit cards through low-cost channels (merchant outlets known as “business correspondents”) that are more accessible to low-income customers. Thus far, 4 of the 11 licensed payment banks are in operation. Moreover, since 4 of the 11 in-principle licensed payment banks already operate mobile wallets, the ability to issue an ATM card helps close the payment loop and makes it easier to convert virtual money into cash, and vice versa.72 The new payments bank model presents an opportunity to increase competition in the sector. This model also allows providers to leverage mobile technology beyond mobile money services. Lastly, this new banking service has the ability to change the banking sector in rural India as long as providers offer a clear value proposition to their rural customers by meeting their payment and remittance needs.

One such payment bank, Paytm, has also introduced a messaging service in its online payment platform which is expected to challenge WhatsApp in India. The service was introduced after Paytm realized that most of their clients utilized social media or messaging platforms before and after conducting transactions.73 Indeed, insights from a nationally representative panel survey on Kenyan mobile phone users in September 2016, conducted by Caribou Digital Data, revealed similar behavior in East Africa: Kenyan mobile money senders are active on a social messaging platform—such as WhatsApp or SMS—30 seconds before and after sending a mobile money transfer. Paytm users’ ability to use additional services such as messaging without leaving the app has the potential to build loyalty and a large, captive audience. This is an example of a provider attempting to foster a complete ecosystem for its customers, as discussed earlier in this Snapshot. Further, Paytm’s banking affiliate is exploring how to offer loans (that are too small to interest a normal bank) with creditworthiness assessed by examining a borrower’s transactions on the service.74 Paytm reported that 100 million Indians visited its service at least once a month in 2017.75

Implications

This Snapshot has illustrated the slow and steady shift of commercial digital offerings—from P2P transfers to more sophisticated products that are not necessarily developed by traditional digital finance providers such as credit products backed by FinTech algorithms and pay as you go energy solutions. These products are developing thanks to the rapid rise of smartphones and the associated capability of digital data trails. It should be noted, however, that the real power of digital data trails is limited to smartphone access and use. While the penetration of smartphones has increased, there is still a ways to go in rural areas—where, arguably, most assistance is needed to improve access to finance.

Additionally, as more digital finance players move from offering a single anchor product to fostering a broader digital ecosystem, acting like “platform players,” they will need to build strong partnerships with FinTechs, such as aggregators that enable collection, disbursement, and payment of services, as well as with other partners. This implies that revenue sharing agreements, currently a point of contention between FinTechs and traditional DFS providers, will need to be more clearly hashed out. At the same time, new players like alternative lenders will need to develop more robust revenue strategies to ensure that their financial support sees a return on investment.

Conclusion

We are witnessing the impact of the shift to digital on the financial services industry, which is leading to increased competition among previously unlikely foes—MNOs, banks, and other third parties. While the average consumer will benefit from competition—with more choice in products and service providers—traditional digital finance actors will need to develop a digital strategy quickly. This shift will likely mean opening APIs, integrating with disruptors, diversifying revenue streams, and, most importantly, being open to innovation in order to tangibly serve the needs of low-income customers.

This is an exciting and evolving space. As digital finance providers shift their strategies and become more innovative, they have the opportunity to provide relevant and tangible value propositions to their customers that will improve their access to finance. As we have illustrated in this Snapshot, some traditional digital finance providers are already making strides. We will keep a keen eye on these developments.

10 Must Reads in this space

- FSD Africa. The Growth of M-Shwari in Kenya—A Market Development Story. FSD Africa, November 2016.

- GSMA. State of the Industry Report on Mobile Money: Decade Edition: 2006-2016, February 2017.

- GSMA. The Mobile Economy—Sub-Saharan Africa 2017, July 6, 2017.

- IFC. Alternative Data Transforming SME Finance, 2017.

- Unlocking the Promise of Big Data to Promote Financial Inclusion, March 14, 2017.

- Anderson, C. Leigh, Travis Reynolds, Pierre Biscaye, Kirby Callaway, Melissa Greenaway, Daniel Lunchick-Seymour, Max McDonald, Marieka Klawitter, and Adam Hayes. Review of Digital Credit Products, April 2017.

- Juntos. Juntos Case Study. n.d.

- Microfinance, E-Commerce, Big Data and China: The Alibaba Story. CGAP, October 11, 2013.

- Vidal, Maria. Digital Delivery Models, March 2017.

- Almazán, Mireya, and Nicolas Vonthron. Mobile Money Profitability: A Digital Ecosystem to Drive Healthy Margins. GSMA, November 2014.

Bibliography

- Aglionby, John. “Safaricom Profits Boosted by Mobile Money Growth.” Financial Times, May 2017. https://www.ft.com/content/6fbd4232-3563-11e7-bce4-9023f8c0fd2e.

- Almazán, Mireya. “G2P Payments & Mobile Money: Opportunity or Red Herring?” Mobile for Development (blog), September 30, 2013. http://www.gsma.com/mobilefordevelopment/programme/mobile-money/g2p-payments-mobile-money-opportunity-or-red-herring.

- Almazán, Mireya, and Nicolas Vonthron. “Mobile Money Profitability: A Digital Ecosystem to Drive Healthy Margins.” GSMA, November 2014. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2015/11/2014_Mobile-money-profitability-A-digital-ecosystem-to-drive-healthy-margins.pdf.

- “BKASH IN BANGLADESH: 24 MILLION CUSTOMERS USING MOBILE MONEY.” Global Payments Summit 2017 (blog), August 2017. https://globalpaymentsummit.com/bkash-bangladesh-24-million-customers-using-mobile-money/.

- Bloomberg New Energy Finance. “Off-Grid Solar Market Trends Report 2016,” February 2016. https://data.bloomberglp.com/bnef/sites/4/2016/03/20160303_BNEF_WorldBankIFC_Off-GridSolarReport_.pdf.

- Bold, Chris, David Porteus, and Sarah Rotman. “Social Cash Transfers and Financial Inclusion: Evidence from Four Countries.” CGAP Focus Note. CGAP, n.d. http://www.cgap.org/sites/default/files/Focus-Note-Social-Cash-Transfers-and-Financial-Inclusion-Evidence-from-Four-Countries-Feb-2012.pdf.

- Braniff, Lauren. “Building a Digital Finance Ecosystem in Zimbabwe.” CGAP (blog), February 2016. http://www.cgap.org/blog/building-digital-finance-ecosystem-zimbabwe.

- CGAP. “The Global Landscape of Digital Finance Innovations.” Economy & Finance, March 2015. https://www.slideshare.net/CGAP/the-global-landscape-of-digital-finance-innovations.

- Chopra, Puneet. “Driving Viability for Banks and Business Correspondents | Microfinance Gateway – CGAP,” November 1, 2011. http://www.microfinancegateway.org/library/driving-viability-banks-and-business-correspondents.

- Cobert, Beth, Briget Helms, and Doug Parker. “Mobile Money: Getting to Scale in Emerging Markets.” McKinsey&Company, May 2012. http://www.mckinsey.com/industries/social-sector/our-insights/mobile-money-getting-to-scale-in-emerging-markets.

- Cook, Tamara, and Claudia McKay. “How M-Shwari Works: The Story So Far.” FSD Kenya & CGAP, April 2015. http://www.cgap.org/sites/default/files/Forum-How-M-Shwari-Works-Apr-2015.pdf.

- Dahir, Abdi Latif. “Kenya’s Little Cab App Is Set to Take on Uber in Uganda and Nigeria.” Kenya’s Little Cab App Is Set to Take on Uber in Uganda and Nigeria (blog), November 2016. https://qz.com/846609/safaricoms-little-cab-a-rival-uber-in-kenya-is-launching-in-nigeria-and-uganda/.

- “Drivers of Mobile Money Profitability.” CGAP (blog), April 28, 2011. http://www.cgap.org/blog/drivers-mobile-money-profitability.

- “Equity Halts Branch Expansion as It Banks on Digital Services – Business Daily.” Accessed September 22, 2017. http://www.businessdailyafrica.com/Corporate-News/Equity-halts-new-branches-as-it-banks-on-digital-expansion/539550-3412508-6regaf/index.html.

- European Investment Bank. “Digital Financial Services in Africa: Beyond the Kenyan Success Story.” European Investment Bank and UNCF Mobile Money for the Poor Programme, December 2014. http://www.eib.org/attachments/country/study_digital_financial_services_in_africa_en.pdf.

- FSD Africa. “The Growth of M-Shwari in Kenya – A Market Development Story.” FSD Africa, November 2016. http://www.fsdafrica.org/wp-content/uploads/2016/11/M-Shwari_Briefing-final_digital.pdf-9.pdf.

- Goel, Vindu. “India’s Top Payments App Adds Chatting, Challenging WhatsApp.” The New York Times, November 2017. https://www.nytimes.com/2017/11/02/technology/india-paytm-whatsapp-mobile-payments.html.

- GSMA. “Messaging as a Platform: The Operator Opportunity,” February 2017. https://www.gsma.com/futurenetworks/wp-content/uploads/2017/02/Network-2020-Maap_Leaflet_Interactive_new.pdf.

- ———. “State of the Industry 2015: Mobile Financial Services for the Unbanked.” GSMA, November 2016. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/11/SOTIR_2015.pdf.

- ———. “State of the Industry Report on Mobile Money: Decade Edition: 2006-2016,” February 2017. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/02/GSMA_State-of-the-Industry-Report-on-Mobile-Money_Final-27-Feb.pdf.

- ———. “The Mobile Economy – Sub-Saharan Africa 2017,” July 6, 2017. https://www.gsmaintelligence.com/research/?file=7bf3592e6d750144e58d9dcfac6adfab&download.

- Katakam, Arunjay. “Setting up Shop: Strategies for Building Effective Merchant Payment Networks.” GSMA, October 2014. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2014/10/2014_DI_Setting-up-shop_Strategies-for-building-effective-merchant-payment-networks.pdf.

- “KCB Group Turning To Facebook, Apple, Alibaba On Digital Payments.” PYMNTS.Com (blog), October 3, 2016. https://www.pymnts.com/news/mobile-payments/2016/kcb-in-talks-with-tech-companies-on-digital-payments/.

- Khan, Imran, Vera Bersudskaya, Sidra Butt-Mughal, and Mimansa Khanna. “Agent Network Accelerator Research: September 2017.” The Helix Institute of Digital Finance, September 2017. http://www.helix-institute.com/sites/default/files/Publications/ANA%20Pakistan%20Country%20Report_0.pdf.

- Khan, Maha, and Jim Williams. “Successful Agent Networks.” The Helix Institute of Digital Finance, January 2017. http://www.helix-institute.com/data-and-insights/successful-agent-networks.

- Leishman, Paul. “Is There Really Any Money in Mobile Money?” GSMA, June 2012. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2012/06/moneyinmobilemoneyfinal63.pdf.

- Maina, Saruni. “Masoko, Safaricom’s E-Commerce Platform, Set to Launch on November 16.” TechWeez (blog), November 2017. http://www.techweez.com/2017/11/03/masoko-ecommerce-platfrom-nov-16/.

- Mas, Ignacio. “Making Mobile Money Daily Relevant.” FSD Tanzania, April 2012. https://www.microfinancegateway.org/sites/default/files/mfg-en-paper-making-mobile-money-daily-relevant-mar-2012.pdf.

- McCaffrey, Mike. “Why Most Agent Networks Will Fail.” Helix Institute of Digital Finance (blog), September 2017. http://www.helix-institute.com/blog/why-most-agent-networks-will-fail.

- McCaffrey, Mike, and Jacqueline Jumah. “Kenya Moves Beyond M-PESA.” The Helix Institute of Digital Finance (blog), May 27, 2015. http://www.helix-institute.com/blog/kenya-moves-beyond-m-pesa.

- McCarty, Yasmina, and Roar Bjaerum. “Easypaisa: Mobile Money Innovation in Pakistan.” GSMA, July 2013. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2013/07/Telenor-Pakistan.pdf.

- Omondi, Dominic. “Safaricom Stirs up Market with Its Masoko E-Commerce Platform.” Standard Digital, November 2017. https://www.standardmedia.co.ke/business/article/2001260847/safaricom-s-masoko-online-store-stirs-up-market.

- Pénicaud, Claire, and Fionán McGrath. “Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland,” July 2013. https://www.gsma.com/mobilefordevelopment/programme/mobile-money/innovative-inclusion-how-telesom-zaad-brought-mobile-money-to-somaliland.

- Rhyne, Elisabeth. “The G2P Silver Bullet? Not So Fast.” Center for Financial Inclusion Blog (blog), October 2016. https://cfi-blog.org/2016/10/11/the-g2p-silver-bullet-not-so-fast/#more-22095.

- Rousset, Melissa. “From Launch to Lift-Off: Lessons from the Beninese Market.” The Helix Institute of Digital Finance (blog), November 2016. http://www.helix-institute.com/blog/launch-lift-lessons-beninese-market.

- Safaricom. “Safaricom Limited Annual Report 2016.” Safaricom Limited, 2016. https://www.safaricom.co.ke/images/Downloads/Resources_Downloads/Safaricom_Limited_2016_Annual_Report.pdf.

- Sathe, Gopal. “What Are Payment Banks, What They Can and Cannot Do, and Who Will They Affect?” Gadgets 360, August 2015. https://gadgets.ndtv.com/internet/features/what-are-payment-banks-what-they-can-and-cannot-do-and-who-will-they-affect-730073.

- Scharwatt, Claire, Arunjay Katakam, Jennifer Frydych, Alix Murphy, and Nika Naghavi. “State of the Industry 2014: Mobile Financial Services for the Unbanked.” GSMA, March 2015. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2015/03/SOTIR_2014.pdf.

- Voorhies, Rodger, Jason Lamb, and Megan Oxman. “Fighting Poverty Profitably.” The Bill & Melinda Gates Foundation, September 2013. https://docs.gatesfoundation.org/Documents/Fighting%20Poverty%20Profitably%20Full%20Report.pdf.

Notes

& acknowledgements

Acknowledgements

Maha Khan wrote this Snapshot, with inputs from Marissa Dean. This Snapshot was supported by the Mastercard Foundation.

Notes

The views presented in this paper are those of the author(s) and the Partnership, and do not necessarily represent the views of the Mastercard Foundation or Caribou Digital.

For questions or comments please contact us at ideas@financedigitalafrica.org.

Recommended citation

Partnership for Finance in a Digital Africa, “Snapshot 8: What is the landscape of digitally-provided commercial offerings? What are the most important considerations for the value propositions, cost structures, and revenue flows of digital financial services?” Farnham, Surrey, United Kingdom: Caribou Digital Publishing, 2017. https://www.financedigitalafrica.org/snapshots/8/2017/.

About the Partnership

The Mastercard Foundation Partnership for Finance in a Digital Africa (the “Partnership”), an initiative of the Foundation’s Financial Inclusion Program, catalyzes knowledge and insights to promote meaningful financial inclusion in an increasingly digital world. Led and hosted by Caribou Digital, the Partnership works closely with leading organizations and companies across the digital finance space. By aggregating and synthesizing knowledge, conducting research to address key gaps, and identifying implications for the diverse actors working in the space, the Partnership strives to inform decisions with facts, and to accelerate meaningful financial inclusion for people across sub-Saharan Africa.

This is work is licensed under the Creative Commons AttributionNonCommercial-ShareAlike 4.0 International License. To view a copy of this license, visit http://creativecommons.org/licenses/by-nc-sa/4.0/.

Readers are encouraged to reproduce material from the Partnership for Finance in a Digital Africa for their own publications, as long as they are not being sold commercially. We request due acknowledgment, and, if possible, a copy of the publication. For online use, we ask readers to link to the original resource on the www.financedigitalafrica.org website.

-

GSMA, “State of the Industry Report on Mobile Money: Decade Edition: 2006-2016.” ↩

-

GSMA. ↩

-

GSMA, “State of the Industry 2015: Mobile Financial Services for the Unbanked.” ↩

-

McCaffrey and Jumah, “Kenya Moves Beyond M-PESA.” ↩

-

McCaffrey and Jumah. ↩

-

Khan and Williams, “Successful Agent Networks.” ↩

-

“BKASH IN BANGLADESH: 24 MILLION CUSTOMERS USING MOBILE MONEY.” ↩

-

GSMA, “State of the Industry Report on Mobile Money: Decade Edition: 2006-2016.” ↩

-

Mas, “Making Mobile Money Daily Relevant.” ↩

-

McCaffrey, “Why Most Agent Networks Will Fail.” ↩

-

Rousset, “From Launch to Lift-Off: Lessons from the Beninese Market.” ↩

-

Rousset. ↩

-

GSMA, “State of the Industry Report on Mobile Money: Decade Edition: 2006-2016.” ↩

-

Katakam, “Setting up Shop: Strategies for Building Effective Merchant Payment Networks.” ↩

-

Scharwatt et al., “State of the Industry 2014: Mobile Financial Services for the Unbanked.” ↩

-

GSMA, “State of the Industry 2015: Mobile Financial Services for the Unbanked.” ↩

-

GSMA, “State of the Industry Report on Mobile Money: Decade Edition: 2006-2016.” ↩

-

GSMA, “State of the Industry 2015: Mobile Financial Services for the Unbanked.” ↩

-

Almazán, “G2P Payments & Mobile Money.” ↩

-

Rhyne, “The G2P Silver Bullet? Not So Fast”; Bold, Porteus, and Rotman, “Social Cash Transfers and Financial Inclusion: Evidence from Four Countries.” ↩

-

Rhyne, “The G2P Silver Bullet? Not So Fast.” ↩

-

Rhyne. ↩

-

CGAP, “The Global Landscape of Digital Finance Innovations.” ↩

-

Digital data trails enables using advanced data analytics on individual mobile call patterns and other transactional data to tailor services and products (CGAP). ↩

-

Bloomberg New Energy Finance, “Off-Grid Solar Market Trends Report 2016.” ↩

-

Cook and McKay, “How M-Shwari Works: The Story So Far.” ↩

-

European Investment Bank, “Digital Financial Services in Africa: Beyond the Kenyan Success Story.” ↩

-

Airtime top ups using mobile money save operators money in two key ways: (1) operators pay lower commissions: the commissions paid to agents for performing cash-in (a necessary step before buying airtime) are typically lower than the discounts at which MNOs sell airtime to the channel; (2) MNOs save on the manufacturing and storage of scratch cards. ↩

-

Leishman, “Is There Really Any Money in Mobile Money?”; Pénicaud and McGrath, “Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland”; Almazán, “G2P Payments & Mobile Money.” ↩

-

Though the data is from 2013, it is indicative of profit estimates from adjacency services for large MNOs in mobile money. Additionally, more recent data on this indicator has not been published to date. Voorhies, Lamb, and Oxman, “Fighting Poverty Profitably.” ↩

-

Pénicaud and McGrath, “Innovative Inclusion: How Telesom ZAAD Brought Mobile Money to Somaliland.” ↩

-

Safaricom, “Safaricom Limited Annual Report 2016.” ↩

-

Cobert, Helms, and Parker, “Mobile Money: Getting to Scale in Emerging Markets.” ↩

-

Almazán and Vonthron, “Mobile Money Profitability: A Digital Ecosystem to Drive Healthy Margins.” ↩

-

Almazán and Vonthron. ↩

-

Cobert, Helms, and Parker, “Mobile Money: Getting to Scale in Emerging Markets.” ↩

-

Cobert, Helms, and Parker. ↩

-

McCarty and Bjaerum, “Easypaisa: Mobile Money Innovation in Pakistan.” ↩

-

Almazán and Vonthron, “Mobile Money Profitability: A Digital Ecosystem to Drive Healthy Margins.” ↩

-

GSMA, “State of the Industry 2015: Mobile Financial Services for the Unbanked.” ↩

-

GSMA, “State of the Industry Report on Mobile Money: Decade Edition: 2006-2016.” ↩

-

Aglionby, “Safaricom Profits Boosted by Mobile Money Growth.” ↩

-

Almazán and Vonthron, “Mobile Money Profitability: A Digital Ecosystem to Drive Healthy Margins.” ↩

-

McCarty and Bjaerum, “Easypaisa: Mobile Money Innovation in Pakistan.” ↩

-

Khan et al., “Agent Network Accelerator Research: September 2017.” ↩

-

Scharwatt et al., “State of the Industry 2014: Mobile Financial Services for the Unbanked.” ↩

-

“Drivers of Mobile Money Profitability.” ↩

-

“Drivers of Mobile Money Profitability.” ↩

-

“Drivers of Mobile Money Profitability.” ↩

-

Safaricom, “Safaricom Limited Annual Report 2016.” ↩

-

Voorhies, Lamb, and Oxman, “Fighting Poverty Profitably.” ↩

-

European Investment Bank, “Digital Financial Services in Africa: Beyond the Kenyan Success Story.” ↩

-

Voorhies, Lamb, and Oxman, “Fighting Poverty Profitably.” ↩

-

Chopra, “Driving Viability for Banks and Business Correspondents | Microfinance Gateway- CGAP.” ↩

-

FSD Africa, “The Growth of M-Shwari in Kenya – A Market Development Story.” ↩

-

GSMA, “The Mobile Economy – Sub-Saharan Africa 2017.” ↩

-

GSMA. ↩

-

GSMA. ↩

-

GSMA, “Messaging as a Platform: The Operator Opportunity.” ↩

-

GSMA. ↩

-

GSMA, “The Mobile Economy: Sub-Saharan Africa 2017.” ↩

-

GSMA. ↩

-

Braniff, “Building a Digital Finance Ecosystem in Zimbabwe.” ↩

-

Dahir, “Kenya’s Little Cab App Is Set to Take on Uber in Uganda and Nigeria.” ↩

-

Maina, “Masoko, Safaricom’s E-Commerce Platform, Set to Launch on November 16.” ↩

-

Omondi, “Safaricom Stirs up Market with Its Masoko E-Commerce Platform.” ↩

-

GSMA, “The Mobile Economy: Sub-Saharan Africa 2017.” ↩

-

“KCB Group Turning To Facebook, Apple, Alibaba On Digital Payments.” ↩

-

“KCB Group Turning To Facebook, Apple, Alibaba On Digital Payments.” ↩

-

“Equity Halts Branch Expansion as It Banks on Digital Services Business Daily.” ↩

-

Sathe, “What Are Payment Banks, What They Can and Cannot Do, and Who Will They Affect?” ↩

-

Sathe. ↩

-

Goel, “India’s Top Payments App Adds Chatting, Challenging WhatsApp.” ↩

-

Goel. ↩

-

Goel. ↩