What we know

The Partnership for Finance in a Digital Africa (FiDA) hopes to catalyze digital financial services (DFS) that are tailored to user needs, varied in terms of services offered, easy for customers to use, and woven into people’s daily lives. To be successful, providers must develop a deep understanding of customer needs and behaviors and the ability to engage with customers using technology. In this context, customer data is paramount to effective product development and delivery. However, while there are emerging opportunities, there are also challenges around collecting, maintaining, and analyzing customer data. Organizations cannot always easily adopt best practices. Moreover, delivering financial services responsibly means adhering to practices that safeguard customers’ privacy and security. While the space itself is new and evolving, best practices around big data analytics are emerging.

In this Snapshot, we discuss learnings around best practices for delivering the next generation of digital financial services successfully and responsibly. Specifically, this Snapshot will focus on how big data analytics can improve product design and the implementation of the next generation of digital financial services. Each subsequent Snapshot Refresh within Learning Theme 9 will focus on a particular type of best practice or on a different part of the value chain, such as financial responsibility practices in delivering next generation digital financial services.

It’s simple: The better you know your customer, the better your product will be

At the end of the day, digital finance providers work to satisfy customers — if a product does not meet customers’ needs and demands, usage will be low and the product will likely fail. Most providers conduct basic research on their clients — for example, telecom providers use demographic and geographic information to decide who to target at a macro level.1 Increasingly, digital data2 (electronic data generated on computers, phones, etc.) enables digital finance providers to overlay information from a wide range of sources to yield more precise, tailored insights for specific target groups. According to CGAP,3 financial service providers can use digital data to:

- Find new customers,

- Deepen customer relationships, and

- Manage risks.

Beyond generating insights, providers can also use digital data to segment customers — that is, to divide a customer base into groups of individuals that are similar in specific ways relevant to financial services. Customer segmentation helps providers understand where significant proportions of their customer base may be stuck in terms of their digital finance journey. For example, a customer at the “awareness” stage may know about a mobile money service but may not understand how to use the service or how it can benefit them. As customers become more knowledgeable and begin to interact with the service, they move through stages along the adoption journey, as illustrated in Figure 1 below.4

Figure 1: A customer’s journey in mobile money adoption

Source: GSMA, Marketing Mobile Money: Top 3 Challenges, June 2012

Research suggests that digital finance providers in low-income countries lag behind their counterparts in developed economies in the systematic collection and analysis of customer data. The GSMA’s “State of the Industry 2015” report found that only 39% of mobile money providers track the gender of customers and only 40% of mobile money providers know the urban/rural split of their user base.5 According to the Global Banking Alliance for Women (2015), the most common reason for not collecting gender disaggregated data is the lack of awareness among providers of the value of such data.6

In addition to the lack of gender disaggregated data, there is evidence that existing business intelligence metrics in the digital finance community could be more nuanced. For example, the pervasive industry definition of active customers is a customer that has made at least one transaction in the last 90 days. However, a 30-day active rate could provide an important benchmark for growth by allowing providers to track individual customers’ breadth and frequency of use in a shorter time period. This would also allow providers to detect seasonal or monthly patterns.

Despite these trends, some digital finance providers have made strides in disaggregating data to segment customers. Earlier this year, JazzCash Pakistan looked specifically at mobile wallet usage data by gender and found that women were not using the JazzCash wallet at the same rate as men.7 In order to improve women’s usage of the mobile wallet, their research partners, Women’s World Banking and ideas42, conducted data analysis to map clients’ behaviors. They found that the real problem was not usage —female customers used JazzCash accounts in very similar ways when compared to males — but acquisition. Female customers accounted for only 15% of new account openings.8 With further research, the team was able to design solutions to accelerate the acquisition of new female customers.

In addition to demographic segmentation, providers are taking advantage of non-traditional, alternative data sources, such as GSM usage (SMS, voice) and mobile money behavior. Providers can use this type of data in various ways as discussed in the following section.

Is big data a big deal?

Indeed, big data is a game-changer in promoting financial services to unbanked and low-income populations

According to Omidyar Network, smartphones possess more processing power than NASA had when they sent the first men to the moon.9 The data generated every minute, every day, by millions of people globally is a massive resource to be leveraged in the push for financial inclusion. Big data generally exhibits five characteristics — veracity, velocity, volume, variety, and complexity.10 In the world’s six biggest emerging economies — China, Brazil, India, Mexico, Indonesia, and Turkey — big data has the potential to help between 325 million and 580 million people gain access to formal credit for the first time.11 Further, there is evidence12 to suggest that big data can:

- Bring both scope and depth to insights by aggregating a large pool of customer data across different dimensions. For example, a payment provider can collect a large volume of data on individuals through each of their transactions (loan repayments, savings deposits, etc.), which can be used to understand customer behavior.

- Enable products to be tailored to the needs of individuals through customer segmentation.

- Improve the reach of financial services by helping providers garner the information they need without a physical presence.

- Change the motivations and behavior of clients, such as using awareness of how repaying a loan can positively affect future credit applications. 13

- Create and improve transparency in information.

- Give providers the ability to collect and analyze more accurate and detailed performance information and consequently improve performance, from supply chain to personnel performance.

- Improve decision-making with automated algorithms.

Recognizing the potential of big data, some financial services providers are racing to develop advanced analytics capable of finding patterns and structure within the massive amount of digitized data being produced.14 However, big data is only meaningful to a provider if it is mined and analyzed to produce deep insights about customers. This is not a trivial task. Typically digital finance providers lack the expertise and internal capacity to fully leverage the potential of big data. In fact, Accion Global Advisory Solutions’ interviews with industry experts and practitioners found that large datasets may not be a first-order concern for many financial service providers working with low-income populations. Rather, many organizations’ most immediate challenge is learning how to leverage small data.15

If big data is employed successfully, it has the potential to deliver cheaper, better financial services to underserved consumers in emerging markets.16 For example, in 2016, Ant Financial, formerly Alipay and an affiliate of Alibaba, provided four million small and microbusinesses with credit, disbursing more than $100 billion in just over five years.17 They attribute their success to competency using big data analytics and reduced costs through cloud computing. The use of big data enabled them to identify use cases for their customers that met their real needs and pain points around credit.18

Similarly, Airtel Money Uganda and the International Finance Corporation (IFC) employed big data analytics to increase the number of active customers — only 12% of customers were active. By analyzing six months of mobile call data records (CDR) and Airtel mobile money transactions, they identified 250,000 high probability active and new customers from their GSM subscriber base. Moreover, geospatial and customer network analysis helped identify new areas of strategic interest, by mapping these new areas against uptake potential variables.19 The research also analyzed the location of transactions and found that 60% of mobile money transfers took place within a 19-kilometer radius in and around Kampala. This geospatial data helped Airtel Money Uganda target their marketing efforts.20

One mode of utilizing big data that has gained traction in the past few years is the analysis of usage and behavior data to determine which customers could be granted small amounts of credit (cash or airtime) which could then be delivered to a wallet or airtime account accordingly. M-Shwari, a combined micro-savings and loan product that launched in 2012 through a collaboration between the Commercial Bank of Africa (CBA) and Safaricom, was one of the first products to experiment with this model. The companies developed a credit scoring algorithm based on a client’s use of M-PESA and Safaricom airtime and data, reaching seven million Kenyans in its first 22 months.21

Tiaxa, a FinTech provider with headquarters in Chile that specializes in giving customers nano-credits, serves as another example. Tiaxa forms three-way partnerships with financial institutions and MNOs whereby financial institutions provide Tiaxa with the lending licenses and the MNOs provide the alternative data (i.e., mobile phone usage) that Tiaxa requires for their credit decision models. In 2010 Tiaxa introduced mobile phone balance advances to prepaid mobile phone subscribers that could go towards users’ voice, text, and data consumption. These advances are usually less than $1 each and, as of 2015, they provided 50 million advances each month. Tiaxa applied big data analytics to understand their MNO clients’ transactions (prepaid) across a variety of indicators. Consequently, Tiaxa can segment the prepaid subscribers according to their likelihood of churn. Advances are given based on mobile phone data: if a subscriber is scored positively by Tiaxa’s algorithm, and the client has subscribed to their service, the transaction is conducted seamlessly, on-demand, and without any interaction from the MNO. In return for backstopping the risk of clients not repaying their loans, Tiaxa shares a portion of the additional revenue with the MNO.22

While the benefits of big data are clear, the majority of digital finance providers in low-income countries are grappling with how to begin the task of collecting and analyzing big data. Indeed, it is no small task to pursue big data analytics. It is likely a bigger task still to convince senior management that using big data analytics to generate a nuanced understanding of customers — that tend to be low-income — can have significant bottom line benefits. The key to success in digital finance is granular level data on customers that explain their needs. Consequently, providers must acquire or develop the resources — both financial and human — to generate and analyze this data. In the following sections, we explore what it takes for organizations to begin the journey of analyzing and employing big data.

Organizations need internal consensus and commitment to launch big data analytics capabilities that support DFS

A decade of industry experience in mobile money services — the “first generation of digital finance” — has taught the digital finance community that a provider must be properly structured and sufficiently resourced to deliver a sophisticated digital finance product.23 Talent and committed leadership are crucial to building this foundation.24 Once this foundation is established, stakeholders across every department of an organization must commit to pursuing their digital finance objectives and targets before they launch their digital financial service. This process of obtaining buy-in helps a provider calibrate the appetite for risk within the organization, as well as growth ambitions. It also serves as a first step towards changing misaligned perceptions, such as how a digital finance business is viewed relative to an organization’s core business. Interviews with mobile money executives indicate that the complexity of a digital finance business, including tailoring products to specific customer needs, necessitates commitment unlike that of traditional Global System for Mobile Communication (GSM) businesses.25

FiDA’s Snapshot 8, “What is the commercial landscape of digital finance?,” discusses the business and financial considerations for providers offering digital financial services in more detail and highlights some of the operational requirements of establishing a digital finance team. Here we will focus specifically on the optimal structures and systems that our research recommends for providers that want to leverage big data analytics.

Simply because of the central role it can and will play in advancing digital finance products, big data can no longer be under the sole charge of an IT department. Accenture, a global management consulting firm specializing in strategy, digital, and technology and operations services, recommends three strategic priorities26 for providers navigating their way to big data analytics:

- Building momentum around the opportunities of big data and injecting an innovative mindset into the organization’s culture.

- Reimagining and designing a new operating data model including building the operational capacity to respond to big data analytics.

- Putting in place leading-edge architecture that can store, analyze, and disseminate the large amounts of data that will be generated.

Evidence indicates that providers need to change their internal cultures to allow for fresh, invigorating ideas and an innovative mindset across teams. This cultural change can take place once the appropriate business roles and advanced analytical and technical skills are on board across the organization — including senior management — to capture the real value of big data.27

Digital finance providers may need to set up new business roles to take responsibility for (1) defining and executing data strategy; (2) identifying and managing data and designing data quality controls; and (3) managing the traceability and reliability of business data. Providers also need to create roles that ensure accountability for data ownership and management.28 It would be wise for providers to first assess whether they have some of these skills in house and what skills they will need to build in order manage big data such as quantitative analysis, IT architecture, and data science.

Secondly, the data operating model should define the roles and responsibilities, as well as the taxonomies and standards for data quality, as part of the overall data governance process. Roles within the data operating model include the data officer as a leader, designing macro data governance processes, assigning roles and responsibilities, and accounting for the reliability of data used for regulatory and financial reporting purposes.29 Other roles that providers should consider adding include a data governance coordinator who oversees the reporting process and use of appropriate data sources, a data quality steward who writes the quality management standards, a data owner, and lastly a data manager who guarantees that the data required for reporting purposes are always available and reliable.

In order to help organizations think through whether they have the resources in house or need to build them, the IFC suggests working through the following framing questions:30

- Who is responsible for managing the data in the enterprise? How?

- Are there any ongoing collaborations with research institutions or qualified organizations which could perform the data science activities?

- Which recruiting channels exist as far as data-driven professionals are concerned?

- How is data culture fostered inside the company? Who is involved?

- How is multidisciplinary collaboration facilitated in project planning and execution?

- How is scientific validity ensured in choosing algorithms and mathematical data representations (modeling)? Is a qualified person ensuring the results are true?

- Who ensures good practices are in place and algorithms are programmed efficiently?

- Is there an open collaboration between the data-driven team and other business units?

Lastly, no provider can capitalize on big data analytics without the appropriate IT systems and architecture. This architecture needs to exhibit three to four main features: flexibility, scalability, data exploration,31 and security standards. Each provider will need to assess their IT architecture for these features and whether the system can generate, store, and analyze data in a secure manner and in compliance with their respective security regulations.

Where does a digital finance provider start in their data journey?

Once the aforementioned strategic priorities have been set, providers should work through a series of steps to ensure they have a framework in place to help them navigate the process of implementing big data analytics. This section outlines the key questions and steps providers can follow to utilize big data.

According to Accion’s toolkit on harnessing big data,32 digital finance providers should go through the following nine steps before embarking on their data journey.

- Understand the data goals: Why is a data strategy being developed, and what business goal can be better evaluated or advanced through data usage and analysis. These business goals may be cross-organizational because introducing data-driven innovations is a multidimensional challenge for any financial services provider that requires the talents and coordination of teams across the organization.33

- Establish a prioritized roadmap of objectives: Prioritize by strategic importance and ease of implementation. Address the immediate needs in the short term, but build a strategy to acquire a unique information advantage over the long term.

- Map business processes and build a data inventory: Identify existing data and map how it is collected and used. The co-founder of M-PESA, Paul Makin, notes that organizations should first allow their business team to play with available data on tools such as Excel, simply “looking for interesting patterns.”34 This process allows organizations to understand their own capacity to generate data and ensures that business insights guide data analytics, rather than the other way around.

- Identify gaps or redundancies in current data collection methods: Identify areas for improvement and a wish list of data points that would make decision making and responsiveness to customers more efficient.

- Understand the IT systems architecture: This is a key step to understanding an organization’s business requirements, functional requirements, and technical requirements.

- Revise the processes and culture: Technology evolves at a fast pace, which means organizations need to keep up with the changes. Providers will want to manage expectations and ensure their strategy is flexible enough to adapt to change. Accion’s research found that financial service providers expected their FinTech partners to drive change and cited failure to do so as the reason that new initiatives were unsuccessful.35

- Don’t go big until ready: Providers usually succeed not because they developed a magic bullet, but because they focused on building their foundation first and foremost. As previously mentioned, providers must ensure they have the necessary internal capacity — starting with the right talent and resources — to see a big data strategy through.

- Plan a data governance strategy and stewardship.

- Roll out across the organization: The work does not stop once providers have rolled out their strategy. It is critical that providers maintain clear communication with their partners throughout implementation. Digital finance providers can benefit from the insights of Kifiya, an Ethiopian digital finance provider. Kifiya partnered with a local microfinance institution (MFI) to deliver branchless banking, and although they had senior level buy-in, the MFI’s technical staff was not on board. Kifiya had to conduct workshops on protocols and implementation plans with the technical staff in order to assuage their fears before implementing the program.36 As a result, Kifiya now has an in-house team to lead similar workshops for its partner organizations.37

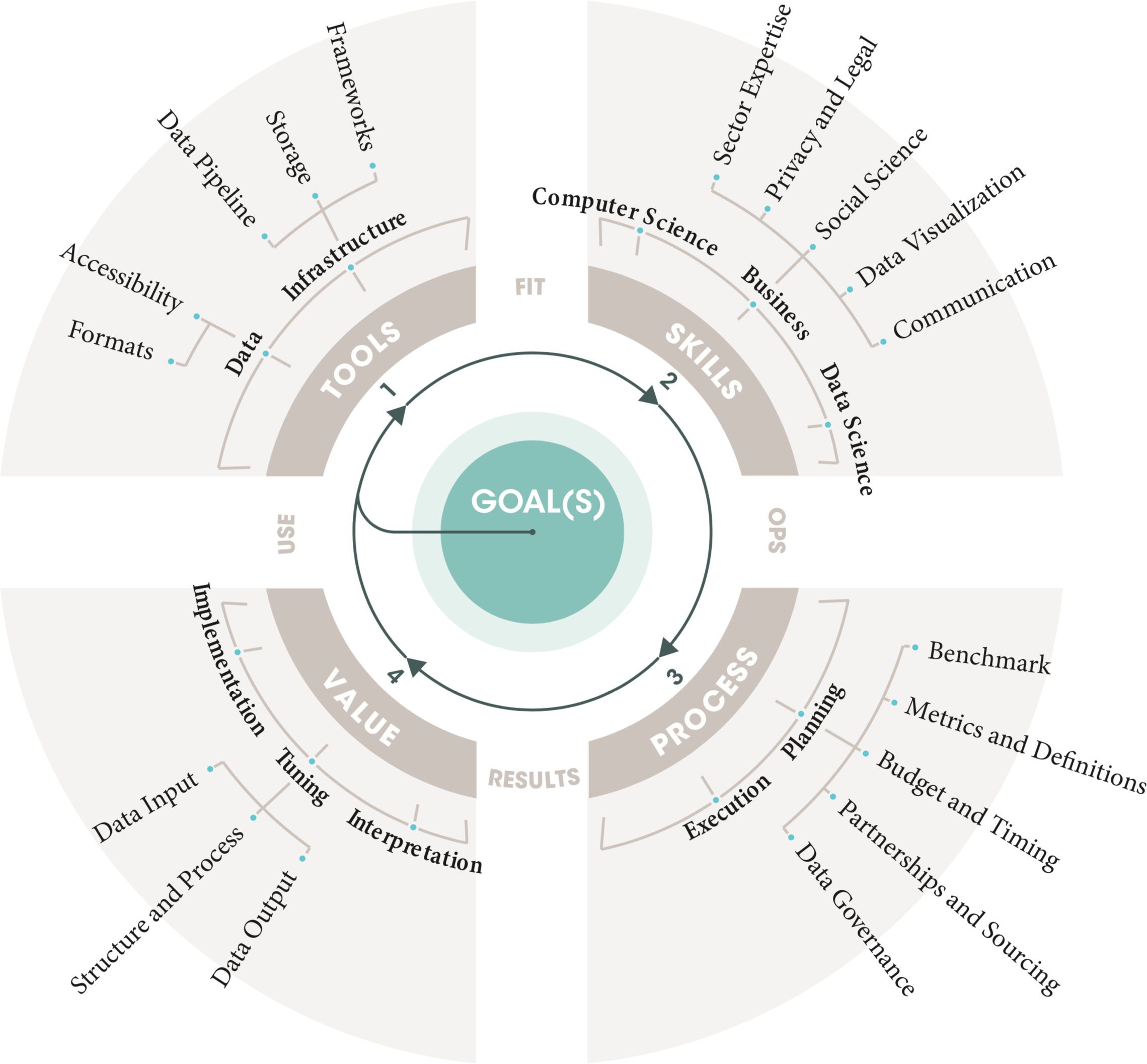

Once providers have gone through these steps and have a big data project to manage, providers can employ the IFC’s “Data Ring.” The Data Ring is a structure that helps organizations think through the core project elements of a data project, its resource requirements, and the relationships between the project elements.38 A core feature of the Data Ring is its circular design which represents the concept of continuous improvement and iterative optimization. There are five core organizational blocks in the Data Ring — goals, tools, process, skills, and value — that are meant to help providers plan and achieve balance between specificity and flexibility throughout the data project’s lifecycle.39 As illustrated in Figure 2, the blocks are further divided into ten components that aid providers’ understanding of how each component connects to and is dependent on the others. Each of these components are provided with guiding framework questions available in the IFC’s Data Analytics and Digital Financial Services Handbook. Providers can use the Data Ring as a checklist, similar to Accion’s Toolkit, as well as a framework to explain the data-driven process of big data analytics.

Figure 2: The Data Ring: A Planning Tool for Data Projects

Source: IFC, Data Analytics and Digital Financial Services Handbook, 2017

Big Data Analytics Challenges

While the aforementioned toolkits are excellent starting points and guides for providers embarking on their data journey, there is no exact formula for success. Providers will need to learn through their experiences and may make mistakes along the way. Given that, digital finance providers that want to employ big data analytics must be cognizant of the challenges. Firstly, the full potential of big data analytics is limited by the use of smartphones. That is, providers may not be able to gain deep customer insights from the large numbers of people that still use feature phones or do not own devices. In this case, digital finance providers can employ other qualitative research methods, such as human centered design (HCD), to design tailored products. Juntos, for example, has helped providers improve customer uptake of mobile money products by developing tools that use a combination of behavioral research and design, customer data analytics, “real-time customer interaction,” and technology.40 The Juntos Finanzas platform enables automated two-way conversations between provider and customers; this personalized interaction empowers customers, builds a relationship between provider and customer, and can change customer behavior over time.41 After four months of providing user-centric messaging services to Mynt Philippines, Juntos saw a 20% increase (when compared to the control group) in their inactive customers’ average transactions.

As highlighted in the Juntos example, a human touch (or a human-like feeling), is still necessary for early DFS adopters. Bindu Ananth of IFMR Trust, speaking of rural India, pointed out that “there [are] attributes of clients that must be observed, such as a person’s family dynamics, or their health. It would be difficult to substitute these rich observations with more abstract forms of digital data.”

A second challenge to big data analytics is securing the data management process — that is, the generation, storage, and analysis of data. Providers may have to integrate different technologies in order to leverage big data analytics which may introduce new security challenges. Since big data systems are complex and heterogeneous, the security approach must be holistic to ensure the availability and continuity of services.42

A report by the European Union Agency for Network and Information Security (ENISA), which studied the use of big data by the private sector (telecom, energy, finance, etc.) as well as research organizations and government agencies across the European Union, highlights the following challenges to secure the use of big data:

- Access control and authentication: A provider should include access control and authentication mechanisms for the different roles that staff and customers have when utilizing a particular service.

- Secure data management: Storage security should be addressed from the beginning of the requirements phase. This service can be built, or could be bought/rented from third-party providers.

- Source validation and filtering: The aggregation of individual data coming from the mobile network can pose relevant security challenges in terms of the equipment of the mobile network, which is composed of multi-vendor technologies. The provider should verify and trust the infrastructure components — both hardware and software — that produce the data and events collected by the big data IT architecture and ensure the proper security provenance of the data.43

Lastly, and perhaps one of the biggest challenges and consequences of big data analytics, is the impact on consumers’ privacy and safety. Do consumers understand how much of their data is being collected by providers? Do consumers know how their data is being used by providers and are customers concerned by this phenomenon? Do providers ensure their customers’ privacy and safety? These are big questions which need further attention and will be discussed in the Implications section below.

Notable new learning

Big data analytics is a relatively new and evolving space within the digital finance community in sub-Saharan Africa. While this Snapshot has recommended certain guidelines and best practices that have developed in this space, providers will want to experiment with the different ways they can generate, store, and analyze big data to tailor products for their customers’ needs and customize the data management process for their organizations’ needs and internal capacity.

To this end, Safaricom and the Commercial Bank of Africa (CBA) announced in December 2017 that M-Shwari, a combined savings and loans product described above, would begin to segment customers who repay their loans on time and have positive savings behavior. M-Shwari will offer loans at cheaper prices to “good” customers and offer a rebate fee for customers who repay on time. The organization plans to explore whether these offers encourage people to “behave” better in terms of their repayments and whether new customers will be inclined to use the service.

Moreover, big data analytics is now being employed in sectors adjacent to financial inclusion, such as the education and energy sectors. M-Kopa, a pay-as-you-go (PAYG) solar energy provider, uses data to design and tailor their services from developing a price point to, more recently, extending a credit product to their customers.44 They are also exploring the adjacent sector of using their solar home systems (SHS) as mini weather stations that generate data on temperature, humidity, solar intensity, and even rainfall and soil moisture content. The provider is investigating the linkage between this use of weather data to agricultural productivity, crop insurance, and predictive weather event monitoring.45

Implications

How safe and private is a customer’s data?

Individual privacy is compromised by big data — in many cases, the primary generators of data are unaware of the data they are generating and the ways in which it is being used.46 As a result, it is prudent for digital finance providers to ensure that appropriate safeguards are in place to protect customer privacy — such as legal frameworks and clear customer opt-in and -out services for data usage, mining, and reuse of data by third-party services.47 Legal frameworks and initiatives must also come from governments to protect customers from attacks by hackers, as this protection can make innovators feel more confident about offering novel products and builds trust among potential customers in the providers and the products.

FirstAccess, an organization that uses big data to analyze the creditworthiness of loan applicants in Tanzania, conducted research with CGAP to establish how well consumers understood their mobile data, how it is used during mobile credit scoring, and what methods of informed consent would be most helpful.48 They found that “it is important to make clear to consumers that mobile credit scoring does not mean non-creditworthy consumers will now be given loans.” 49

The study also discovered that although consumers are interested in how data is used, their need for a loan superseded concerns regarding privacy. Thus, they were more concerned with the way their information was being used than with the privacy of their information. Although FirstAccess shares information with consumers on their data privacy rights via SMS, the research found that the messaging did not adequately explain the process for consumers. Customers typically demanded more information which suggests that providers should send multiple SMS messages and supply printed brochures and a call center for follow-up information.50 This case study also demonstrates that informed consent — wherein consumers are given the opportunity to grant or deny the use of their data — should be a best practice in the industry.

In addition to customer safety and privacy, digital finance providers that would like to utilize big data to tailor products to new customers will likely face changes in the way they do business as well as in their internal cultures. Employing big data analytics essentially requires a transformation in business practices including the development of an innovative mindset, personnel and process changes, and even new or revised IT architecture. Digital finance providers must make such shifts with the support of senior management who are invested in big data analytics as a route to reaching new customers.

Conclusion

As people increasingly weave digital technology into their lives, financial services providers have an opportunity to use the data generated from these digital interactions (i.e., big data) to create tailored products that address customers’ financial gaps and draw in new customers previously excluded from formal financial services. The advent of big data presents a watershed opportunity for the digital finance community, if harnessed appropriately. Providers will need to consider whether they are appropriately resourced — financially, technologically, and in terms of the right talent — to capitalize on big data analytics and allow big data to help them move forward in advancing next generation financial services.

10 Must Reads in this space

- Blumenstock, Joshua, Gabriel Cadamuro, and Robert On. Predicting Poverty and Wealth from Mobile Phone Metadata. Science 350, no. 6264 (2015): 1073–1076.

- Chen, Gregory, and Xavier Faz. Hype or Hope? Implications of Big Data for Financial Inclusion. CGAP, September 4, 2014.

- Chen, Gregory, and Xavier Faz. The Potential of Digital Data: How Far Can It Advance Financial Inclusion? CGAP, January 2015.

- Costa, Arjuna, Anamitra Deb, and Michael Kubzansky. Big Data, Small Credit: Digital Revolution and Its Impact on Emerging Market Consumers. Omidyar Network, 2015.pdf

- Gupta, Nirant. How Analytics Drive Innovative Financial Services for the Poor. CGAP, September 11, 2014.

- IFC. Data Analytics and Digital Financial Services Handbook, 2017.

- IFC. Alternative Data Transforming SME Finance, May 2017.

- Levin, Philip, and Gunnar Camner. Getting the Most Out of Your Data Segmenting Your Mobile Money Customer Base to Drive Usage. GSMA, July 2013.pdf

- Mazer, Rafe, and Michelle Kaffenberger. Simple Messages Help Consumers Understand Big Data. CGAP, September 29, 2014.

- Yaworsky, Kathleen, Dwijo Goswami, and Prateek Shrivastava. Unlocking the Promise of Big Data to Promote Financial Inclusion. Accion Global Advisory Solutions, March 14, 2017.

Bibliography

- Chen, Gregory, and Xavier Faz. “Hype or Hope? Implications of Big Data for Financial Inclusion.” CGAP (blog), September 4, 2014. http://www.cgap.org/blog/hype-or-hope-implications-big-data-financial-inclusion.

- ———. “The Potential of Digital Data: How Far Can It Advance Financial Inclusion?” CGAP, January 2015. https://www.cgap.org/sites/default/files/Focus-Note-The-Potential-of-Digital-Data-Jan-2015_1.pdf.

- Cook, Tamara, and Claudia McKay. “How M-Shwari Works: The Story So Far.” FSD Kenya & CGAP, April 2015. http://www.cgap.org/sites/default/files/Forum-How-M-Shwari-Works-Apr-2015.pdf.

- Costa, Arjuna, Anamitra Deb, and Michael Kubzansky. “Big Data, Small Credit: Digital Revolution and Its Impact on Emerging Market Consumers.” Omidyar Network, 2015. https://www.omidyar.com/sites/default/files/file_archive/insights/Big%20Data,%20Small%20Credit%20Report%202015/BDSC_Digital%20Final_RV.pdf.

- Deb, Anamitra. “It’s Time to Listen to the Voice of the Consumer.” CGAP (blog), September 22, 2014. http://www.cgap.org/blog/its-time-listen-voice-consumer.

- Global Banking Alliance for Women (GBA), Data2X, and Multilateral Investment Fund of the Inter-American Development Bank. “The Value of Sex-Disaggregated Data,” 2015. http://www.gbaforwomen.org/download/draft-report-measuring-womens-financial-inclusion/.

- GSMA. “State of the Industry 2015: Mobile Financial Services for the Unbanked.” GSMA, November 2016. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2016/11/SOTIR_2015.pdf.

- Herrera, Miguel. “Leveraging Mobile Phone Data: Tiaxa’s Balance Advance.” CGAP (blog), September 15, 2014. http://www.cgap.org/blog/leveraging-mobile-phone-data-tiaxa%E2%80%99s-balance-advance.

- IFC. “Data Analytics and Digital Financial Services Handbook,” 2017. http://www.ifc.org/wps/wcm/connect/22ca3a7a-4ee6-444a-858e-374d88354d97/IFC+Data+HandBook+FINAL.pdf?MOD=AJPERES.

- Khan, Maha, and Jim Williams. “Successful Agent Networks.” The Helix Institute of Digital Finance, January 2017. http://www.helix-institute.com/data-and-insights/successful-agent-networks.

- Levin, Philip. “Organisational Design to Succeed in Mobile Money.” GSMA, 2012. http://www.gsma.com/mobilefordevelopment/wp-content/uploads/2012/10/2012_MMU_Organisational-design-to-succeed-in-mobile-money.pdf.

- Levin, Philip, and Gunnar Camner. “Getting the Most Out of Your Data Segmenting Your Mobile Money Customer Base to Drive Usage.” GSMA, July 2013. https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2013/07/2013_MMU_Getting-the-most-out-of-your-data.pdf.

- Mazer, Rafe, Jessica Carta, and Michelle Kaffenberger. “Informed Consent: How Do We Make It Work for Mobile Credit Scoring.” CGAP, September 2, 2014. http://www.cgap.org/sites/default/files/Working-Paper-Informed-Consent-in-Mobile-Credit-Scoring-Aug-2014.pdf.

- Mazer, Rafe, and Michelle Kaffenberger. “Simple Messages Help Consumers Understand Big Data.” CGAP (blog), September 29, 2014. http://www.cgap.org/blog/simple-messages-help-consumers-understand-big-data.

- M-Kopa Solar. “Digital Insights Build Trust and Enable Growth,” October 24, 2016. http://www.m-kopa.com/digital-insights-build-trust-enable-growth/.

- Naydenov, Rossen, Dimitra Liveri, Lionel Dupre, Eftychia Chalvatzi, and Christina Skouloudi. “Big Data Security: Good Practices and Recommendations on the Security of Big Data Systems.” European Union Agency for Network and Information Security (ENISA), December 2015.

- Porteous, David. “Is It China’s Golden Age in Digital Financial Inclusion?” Fibr Blog (blog), August 1, 2016. https://medium.com/fibr/is-it-chinas-golden-age-in-digital-financial-inclusion-85ad7c6ed9d0#.lqtp4q8up.

- Porteus, David. “Is It China’s Golden Age in Digital Financial Inclusion?,” August 2016. https://blog.fibrproject.org/is-it-chinas-golden-age-in-digital-financial-inclusion-85ad7c6ed9d0.

- Sarocco, Fabrizio, Vincenzo Morabito, and Gregor Meyer. “Exploring Next Generation Financial Services: The Big Data Revolution,” 2016. https://www.accenture.com/t20160531T050317__w__/us-en/_acnmedia/PDF-21/Accenture-Next-Gen-Financial-Services-Big-Data-Revolution.pdf.

- Valenzuela, Myra, Nina Holle, and Wameek Noor. “Juntos Finanzas – A Case Study.” CGAP, October 2015. http://www.cgap.org/sites/default/files/Working-Paper-Juntos-Finanzas-A-Case-Study-Oct-2015.pdf.

- Women’s World Banking. “Designing Better Digital Financial Services for Women: Lessons in Behavioral Design,” December 11, 2017. https://www.womensworldbanking.org/news/blog/designing-better-digital-financial-services-women-lessons-behavioral-design/.

- Yaworsky, Kathleen, Dwijo Goswami, and Prateek Shrivastava. “Unlocking the Promise of Big Data to Promote Financial Inclusion.” Accion Global Advisory Solutions, March 14, 2017. https://www.accion.org/content/unlocking-promise-big-data-promote-financial-inclusion.

Notes

& acknowledgements

Acknowledgements

Maha Khan wrote this Snapshot, with inputs from Marissa Dean. This Snapshot was supported by the Mastercard Foundation.

Notes

The views presented in this paper are those of the author(s) and the Partnership, and do not necessarily represent the views of the Mastercard Foundation or Caribou Digital.

For questions or comments please contact us at ideas@financedigitalafrica.org.

Recommended citation

Partnership for Finance in a Digital Africa, “Snapshot 9: Best Practices in Big Data Analytics,” Farnham, Surrey, United Kingdom: Caribou Digital Publishing, 2017. https://www.financedigitalafrica.org/snapshots/9/2017/.

About the Partnership

The Mastercard Foundation Partnership for Finance in a Digital Africa (the “Partnership”), an initiative of the Foundation’s Financial Inclusion Program, catalyzes knowledge and insights to promote meaningful financial inclusion in an increasingly digital world. Led and hosted by Caribou Digital, the Partnership works closely with leading organizations and companies across the digital finance space. By aggregating and synthesizing knowledge, conducting research to address key gaps, and identifying implications for the diverse actors working in the space, the Partnership strives to inform decisions with facts, and to accelerate meaningful financial inclusion for people across sub-Saharan Africa.

This is work is licensed under the Creative Commons AttributionNonCommercial-ShareAlike 4.0 International License. To view a copy of this license, visit http://creativecommons.org/licenses/by-nc-sa/4.0/.

Readers are encouraged to reproduce material from the Partnership for Finance in a Digital Africa for their own publications, as long as they are not being sold commercially. We request due acknowledgment, and, if possible, a copy of the publication. For online use, we ask readers to link to the original resource on the www.financedigitalafrica.org website.

-

Chen and Faz, “Hype or Hope? Implications of Big Data for Financial Inclusion.” ↩

-

More broadly, digital data seeks to capture elements of the physical world and simulate them for technological use, for example, by storing complex audio, video, or text information in a series of binary characters, traditionally ones and zeros, or “on” and “off” values. (Accion Global, Unlocking the Promise of Big Data to Promise Financial Inclusion). ↩

-

Chen and Faz, “The Potential of Digital Data: How Far Can It Advance Financial Inclusion?” ↩

-

Levin and Camner, “Getting the Most Out of Your Data Segmenting Your Mobile Money Customer Base to Drive Usage.” ↩

-

GSMA, “State of the Industry 2015: Mobile Financial Services for the Unbanked.” ↩

-

Global Banking Alliance for Women (GBA), Data2X, and Multilateral Investment Fund of the Inter-American Development Bank, “The Value of Sex-Disaggregated Data.” ↩

-

Women’s World Banking, “Designing Better Digital Financial Services for Women: Lessons in Behavioral Design.” ↩

-

Women’s World Banking. ↩

-

Costa, Deb, and Kubzansky, “Big Data, Small Credit: Digital Revolution and Its Impact on Emerging Market Consumers.” ↩

-

IFC, “Data Analytics and Digital Financial Services Handbook.” ↩

-

Costa, Deb, and Kubzansky, “Big Data, Small Credit: Digital Revolution and Its Impact on Emerging Market Consumers.” ↩

-

Chen and Faz, “Hype or Hope? Implications of Big Data for Financial Inclusion.” ↩

-

Chen and Faz. ↩

-

Costa, Deb, and Kubzansky, “Big Data, Small Credit: Digital Revolution and Its Impact on Emerging Market Consumers.” ↩

-

Yaworsky, Goswami, and Shrivastava, “Unlocking the Promise of Big Data to Promote Financial Inclusion.” ↩

-

Deb, “It’s Time to Listen to the Voice of the Consumer.” ↩

-

Porteous, “Is It China’s Golden Age in Digital Financial Inclusion?” ↩

-

Porteus, “Is It China’s Golden Age in Digital Financial Inclusion?” ↩

-

IFC, “Data Analytics and Digital Financial Services Handbook.” ↩

-

IFC. ↩

-

Cook and McKay, “How M-Shwari Works: The Story So Far.” ↩

-

Herrera, “Leveraging Mobile Phone Data: Tiaxa’s Balance Advance.” ↩

-

Levin, “Organisational Design to Succeed in Mobile Money.” ↩

-

Khan and Williams, “Successful Agent Networks.” ↩

-

Levin, “Organisational Design to Succeed in Mobile Money.” ↩

-

Sarocco, Morabito, and Meyer, “Exploring Next Generation Financial Services: The Big Data Revolution.” ↩

-

Sarocco, Morabito, and Meyer. ↩

-

Sarocco, Morabito, and Meyer. ↩

-

Sarocco, Morabito, and Meyer. ↩

-

IFC, “Data Analytics and Digital Financial Services Handbook.” ↩

-

Sarocco, Morabito, and Meyer, “Exploring Next Generation Financial Services: The Big Data Revolution.” ↩

-

Yaworsky, Goswami, and Shrivastava, “Unlocking the Promise of Big Data to Promote Financial Inclusion.” ↩

-

Yaworsky, Goswami, and Shrivastava. ↩

-

Yaworsky, Goswami, and Shrivastava. ↩

-

Yaworsky, Goswami, and Shrivastava. ↩

-

Yaworsky, Goswami, and Shrivastava. ↩

-

Yaworsky, Goswami, and Shrivastava. ↩

-

IFC, “Data Analytics and Digital Financial Services Handbook.” ↩

-

IFC. ↩

-

Valenzuela, Holle, and Noor, “Juntos Finanzas — A Case Study.” ↩

-

Valenzuela, Holle, and Noor. ↩

-

Naydenov et al., “Big Data Security: Good Practices and Recommendations on the Security of Big Data Systems.” ↩

-

Naydenov et al. ↩

-

M-Kopa Solar, “Digital Insights Build Trust and Enable Growth.” ↩

-

M-Kopa Solar. ↩

-

IFC, “Data Analytics and Digital Financial Services Handbook.” ↩

-

IFC. ↩

-

Mazer and Kaffenberger, “Simple Messages Help Consumers Understand Big Data.” ↩

-

Mazer, Carta, and Kaffenberger, “Informed Consent: How Do We Make It Work for Mobile Credit Scoring.” ↩

-

Mazer and Kaffenberger, “Simple Messages Help Consumers Understand Big Data.” ↩